Advertisement

Advertisement

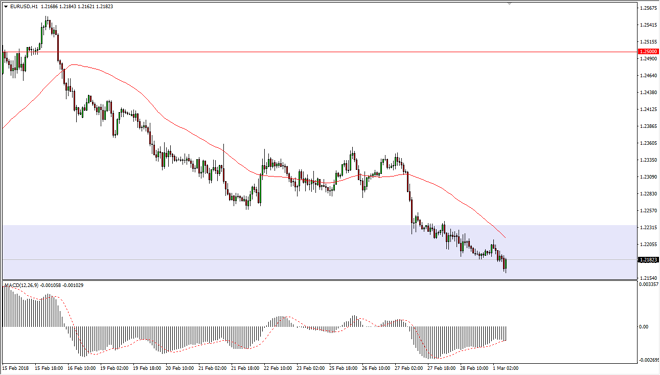

EUR/USD Price Forecast March 2, 2018, Technical Analysis

Updated: Mar 2, 2018, 05:34 GMT+00:00

The EUR/USD pair has drifted a bit lower during the trading session on Thursday, reaching down towards the 1.2150 region. There should be support in this area, especially down to the 1.21 handle. Because of this, I’m waiting for a buying opportunity in this market and have no interest in shorting as I believe there is much more room to the upside.

The EUR/USD pair has pulled back a bit during the trading session on Thursday, reaching down towards the 1.2150 level. There is even more support at the 1.21 handle, as it was the scene of a major breakout previously. Because of this, market memory would dictate that we could have plenty of buyers looking to take advantage of that level. I believe that if we break down below the 1.21 handle, then things change, and we could perhaps be looking at a very negative sign.

However, the uptrend line that coincides with the 1.21 region also offers reason enough to think that the buyers will return. I also recognize that a break above the 1.2250 level above is resistance, perhaps offering a bit of noise. However, if we break above that level, the market could reach towards the 1.25 handle above. That’s an area that is massively resistive, but I think given enough time we will continue to go to the 1.32 handle as it is the measurement based upon the bullish flag on the weekly chart that broke out recently.

Interest rates in America look to be going higher, but I think it’s only a matter of time before trader start to pay attention to the European Central Bank again, and the fact that it is getting ready to step away from quantitative easing. Remember, the markets are forward-looking, and therefore will have essentially priced and most of the American action.

EURUSD analysis Video 02.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement