Advertisement

Advertisement

EUR/USD Price Forecast September 5, 2018, Technical Analysis

Updated: Feb 3, 2018, 05:42 GMT+00:00

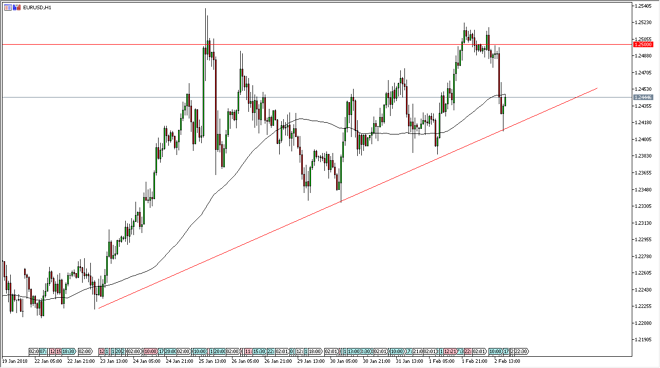

The EUR/USD pair has been volatile during the Friday trading session but formed a perfect hammer at the uptrend line to start going higher again. This tells me that the market is trying to break out above the 1.25 handle, and that it’s only a matter of time before it does. Once it does, the market is very likely to continue showing bullish pressure, as the US dollar comes unwound.

The EUR/USD pair has been very volatile over the last several sessions, dropping down towards the previous uptrend line, and forming a significant hammer. We bounce from there, and it looks as if we are trying to build up the necessary momentum to finally break out above the 1.25 level and go much higher. The US dollar has been getting hammered most of the year, and of course going into 2018. I think this is a trend that continues, and it’s likely that these pullbacks offer more than enough opportunity to pick up value in what has been a very strong and reliable trend.

The jobs number has been very strong, and that initially sent the US dollar much higher, but you can see that a reversion to the mean is starting to happen on the hourly chart, meaning that we will continue to build up the necessary pressure to rally again. If we break down below the uptrend line, roughly the 1.24 level, then I think we could drop a bit further. Nonetheless, I anticipate seeing this market eventually break out to the upside although it is going to be very noisy in the meantime. Once we do breakout to the upside, I anticipate that a move to the 1.2750 level is probably going to be what happens next, but it will obviously be something that needs momentum.

EUR/USD Video 05.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement