Advertisement

Advertisement

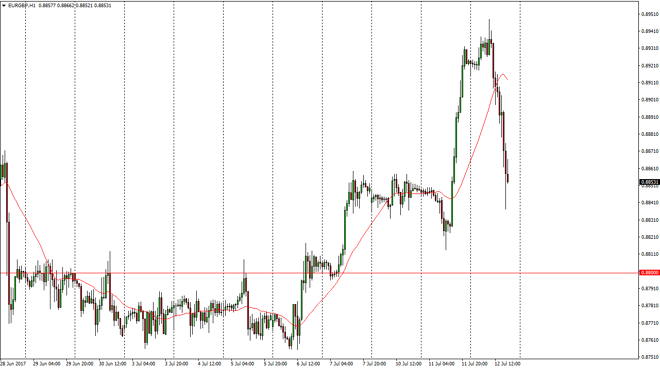

EUR/GBP Forecast July 13, 2017, Technical Analysis

Updated: Jul 13, 2017, 06:55 GMT+00:00

The EUR/GBP pair went sideways initially during the day and then fell off a cliff as we slammed into the 0.8850 level underneath. The market is still in

The EUR/GBP pair went sideways initially during the day and then fell off a cliff as we slammed into the 0.8850 level underneath. The market is still in an uptrend overall, but it certainly looks as if the buyers are taking a bit of a breather. I would be a bit cautious, but I certainly am not willing to sell. I think some type of bounce could be a nice buying opportunity, and I believe that the 0.88 level underneath should be the “floor” in the market. If we see above there, I look at pullbacks that show signs of bouncing as buying opportunities. The 0.90 level above will be the target longer-term, but I think there is going to be a lot of volatility as we continue to talk about the exit of the United Kingdom from the European Union.

Headlines will make this dangerous

The headlines coming out of the negotiations between London and Brussels will continue to make this a very volatile market, but it still looks as if overall, we are favoring the upside. We may have just gotten a bit overbought, but nonetheless I think that the volatility will continue to be a serious issue, especially considering that the volume will be a bit restricted as we are in the middle of summer. Given enough time, we will have to make a longer-term decision as to which direction to go, and right now I currently look as if most traders will be looking to the upside. However, I expect that this is going to be a very dangerous market, so smaller positions might be the best way to deal with it, and looking at the currency pair as whether it is “overbought” or possibly “oversold.” Range bound trading with an upward bias is probably what we are looking at.

EUR/GBP Video 13.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement