Advertisement

Advertisement

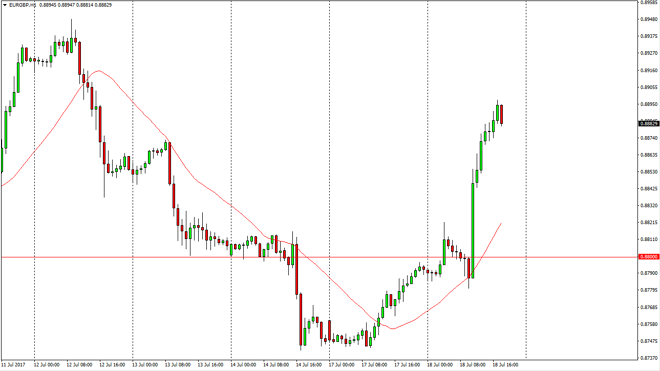

EUR/GBP Forecast July 19, 2017, Technical Analysis

Updated: Jul 19, 2017, 05:56 GMT+00:00

The EUR/GBP pair broke out during the day on Tuesday, as the EUR has rallied overall. We had a bit of a perfect storm, as the EUR/USD pair broke above the

The EUR/GBP pair broke out during the day on Tuesday, as the EUR has rallied overall. We had a bit of a perfect storm, as the EUR/USD pair broke above the 1.15 handle, this of course had people buying the EUR overall, and at the same time we had the British pound fell apart due to less than expected CPI numbers coming out of London. This obviously translated into higher rates in this market, and now we have broken above the 0.8880 level. The market is probably going to pull back a little bit but I think there’s plenty of buying opportunities below on supportive candles. I think that eventually we will go looking for the 0.90 level, and possibly even higher than that.

Buying dips

I continue to buy dips in this market, but believe that it will be volatile due to the negotiations between the European Union and the United Kingdom. Because of this, it’s probably only a matter of time before we get a turn around, regardless of which direction we go. I do favor the upside longer-term though, and I believe that the 0.88 level will probably offer a bit of a floor in this market. I think that the market will continue to find people willing to pick up value in this market, because the breakout of the EUR above the 1.15 level in the EUR/USD pair is such a massive signal. The consolidation that we broke out of was almost 3 years long, so it’s a very bullish sign for the EUR overall. While the British pound will probably continue to go higher, the reality is that the EUR is favored overall, so I think that we continue to see bullish pressure in this market, and therefore will be trading as such.

EUR/GBP Video 19.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement