Advertisement

Advertisement

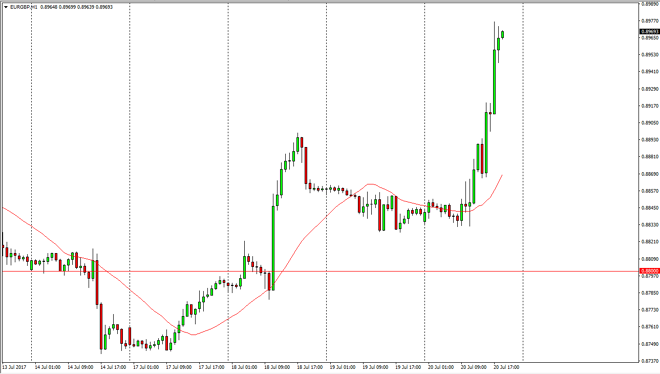

EUR/GBP Forecast July 21, 2017, Technical Analysis

Updated: Jul 21, 2017, 05:26 GMT+00:00

The EUR/GBP pair broke out to the upside during the trading session on Thursday, as we cleared the 0.89 handle. The market looks very likely to reach

The EUR/GBP pair broke out to the upside during the trading session on Thursday, as we cleared the 0.89 handle. The market looks very likely to reach towards the 0.90 level now, which I think is significant resistance. I believe the pullbacks are buying opportunities, that the market will continue the overall uptrend that we have seen for some time. Because of this, I believe that it’s only a matter of time before the buyers return, so I have no interest in shorting. I recognize that the 0.90 level will be resistance, but it’s only a matter of time before we break through that in my estimation. The move to the upside was so explosive that I think a lot of traders will be looking for buying opportunities and of course value.

Looking for support at 0.89

I believe that a pullback from here should find plenty of support at the 0.89 level, and that’s exactly what I’m looking for, an opportunity to find value underneath. I think if we can break above the 0.90 level, the market should continue to go even higher as I believe we will probably then reach towards the 0.92 level. The market is bullish, and therefore I don’t have any interest in selling, least not anytime soon as it appears that the Euro continues to enjoy strength against the British pound in general. Adding. Her full to the fire, the EUR/USD pair has broken out to the upside, which of course has a bit of a knock-on effect in this market, and should continue to push this pair much higher over the longer term. This type of move is very impulsive, and more importantly: obvious.

EUR/GBP Video 21.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement