Advertisement

Advertisement

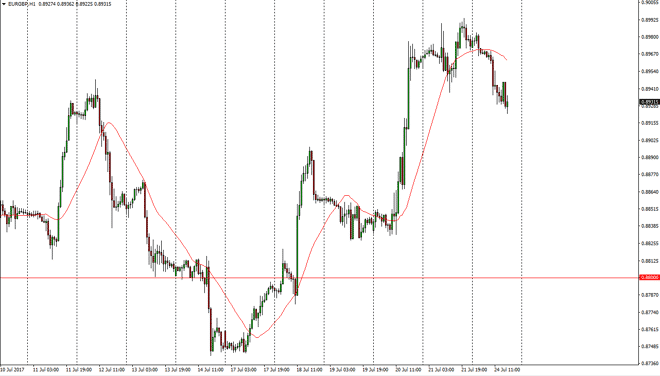

EUR/GBP Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:13 GMT+00:00

The EUR/GBP pair fell during the session on Monday, breaking down below the 0.8950 level. The market looks likely to go looking for the next previous

The EUR/GBP pair fell during the session on Monday, breaking down below the 0.8950 level. The market looks likely to go looking for the next previous resistance area at the 0.89 handle. I think at that point it should continue to show an area of interest. I believe that the market should find interest in that area, but now that we are rolling over I suspect that we are going to see quite a bit of volatility regardless. The market should continue to go to the 0.90 level above, but I think we need to pull back to form a bit of value in the market that they are going to want to take advantage of. This is a market that will continue to be very choppy, and quite frankly is going to be susceptible to external forces.

Negotiations

Unfortunately, there are going to be headlines coming around the world and from members of governments on both sides of the English Channel that will move this market. Because of this, sudden and volatile moves are likely, but the uptrend is still intact, so I am much more comfortable buying this pair than selling it, and perhaps we are simply looking for value underneath it to take advantage of, so that we can start buying again. Ultimately, the market is going to continue to be very difficult to navigate with a full-size position, because of all of the potential disruptors. Nonetheless, if I had to pick one direction, it would be higher, but I would be patient enough to wait for the bounce to take advantage of what should be considered value in this currency pair. Most currency traders that I talked to favor the EUR over the British pound longer term, but that doesn’t mean it’s going to go straight up.

EUR/GBP Video 25.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement