Advertisement

Advertisement

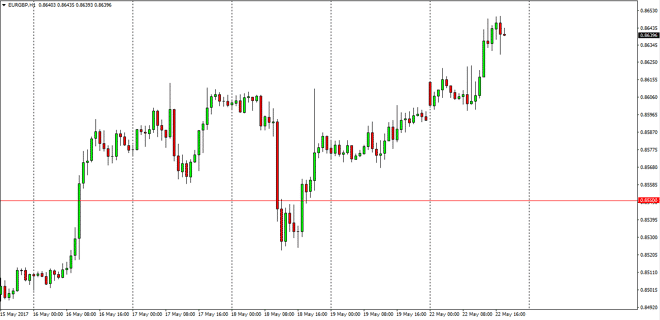

EUR/GBP Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:05 GMT+00:00

The EUR/GBP pair gapped higher at the open on Monday, and then fell almost immediately to fill that gap so that it can continue to go even higher. We

The EUR/GBP pair gapped higher at the open on Monday, and then fell almost immediately to fill that gap so that it can continue to go even higher. We broke towards the 0.8650 level, that of course is a very bullish sign. This pair looks as if it is ready to continue going higher over the longer term, mainly because of the action during the day reacting to Angela Merkel suggesting that the value of the currency was too low and it was the fault of the European Central Bank. With this in mind, I believe that buying dips will probably be the best way to play this market over the longer term, perhaps reaching towards the 0.87 level above.

Longer-term uptrend?

We have had a longer-term uptrend for some time, but over the last several months have struggled to make heads nor tales of which direction to go next. I believe that the buyers are starting to become a bit more aggressive, and it means that the market will continue to favor those dips as value. Even though I like the British pound in general, I think that the EUR is winning this particular argument. With this, I believe that the 0.87 level will be targeted, and then the 0.88 level which is massively important on the longer-term charts. As far selling is concerned, I certainly won’t do it until we break well below the 0.86 handle, which could have ramifications in this market and send it down to the 0.8550 level underneath. This market continues to be very volatile, mainly because it will be hostage to headlines coming out of both Brussels and London when it comes to the divorce of the United Kingdom from the European Union. It will continue to be very difficult.

EUR/GBP Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement