Advertisement

Advertisement

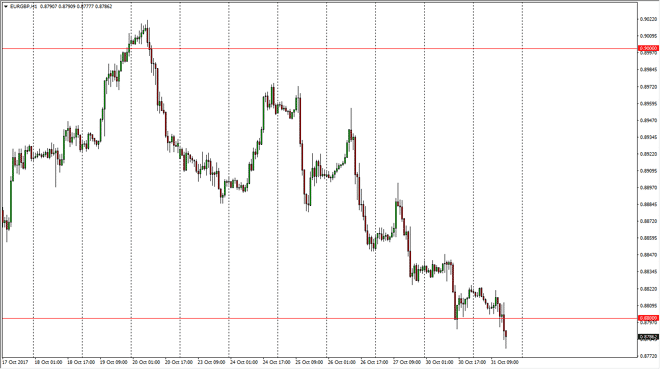

EUR/GBP Forecast November 1, 2017, Technical Analysis

Updated: Nov 1, 2017, 05:34 GMT+00:00

The EUR/GBP pair fell a bit during the day on Tuesday, piercing the 0.88 handle. However, we are starting to see buyers in this general vicinity are

The EUR/GBP pair fell a bit during the day on Tuesday, piercing the 0.88 handle. However, we are starting to see buyers in this general vicinity are ready, and it’s likely that we could continue to be in the consolidation range that we been in for some time. The 0.90 level above should continue to be resistive, and a bit of a target if we can get the bounce. I’d be a buyer above the 0.8825 handle, which gives us an opportunity to pick up value in a market that has continued to show itself to be resilient. Ultimately, this is a market that I believe continues to be noisy due to the negotiations between London and Brussels, and of course the uncertainty in the United Kingdom after leaving the European Union. The market should continue to be noisy, but I think that the consolidation makes quite a bit of sense, because this breakup will cut both ways in the end. We are in a longer-term uptrend, so the resiliency is not surprising.

However, if we break the 0.8750 level, then obviously the support has been crushed, and we could continue to go much lower, perhaps the 0.86 handle underneath. The market should continue to be noisy because of this, but ultimately this is a market that I believe is at an inflection point, so we will have to see how this week plays out. This could give us a direction for the next several months, as although we have been negative for several days in a row, the longer-term charts don’t look as convincing. I have those couple of trigger prices, and until then I think it’s just noise that we will be looking at more than anything else. Smaller position sizing could be handy as well.

EUR/GBP Video 01.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement