Advertisement

Advertisement

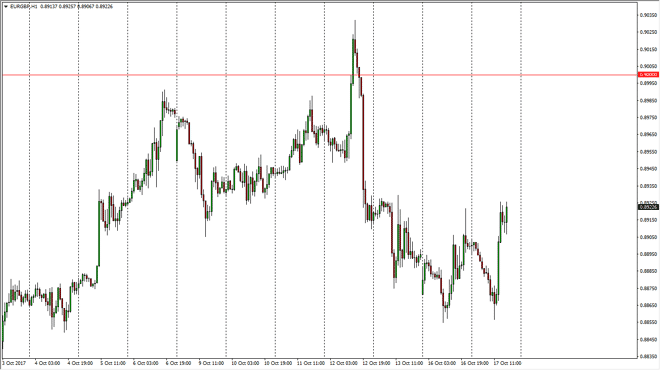

EUR/GBP Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 04:52 GMT+00:00

The EUR/GBP pair initially fell on Tuesday, but turned around at the 0.8850 level to bounce drastically, breaking above the open for the day, showing

The EUR/GBP pair initially fell on Tuesday, but turned around at the 0.8850 level to bounce drastically, breaking above the open for the day, showing extreme strength. It looks very likely that the market is going to continue to reach towards the 0.90 level above. Ultimately, this is a market that will be very volatile, but I think that the buyers are certainly coming back into favor, and a break above the 0.8930 level should send this market looking for the 0.90 level rather quickly. A break above that level census market looking to the 0.92 level, and then of course the 0.95 level after that. Ultimately, this market should continue to find plenty of interest, and that the traders will continue to favor the Euro over the Pound, due to the more certain conditions on the continent. After all, we already know what the European Union is going to be, we have no idea how things play out in the United Kingdom yet.

Buying the dips

I believe the most traders will continue to buy the dips, and therefore it’s a market that I have no interest in shorting. Given enough time, the market should find buyers, and I have no interest in shorting. That is of course unless we break down below the 0.88 handle, which is massively supportive. A breakdown below there would be rather negative, perhaps sending us down to the 0.86 level. Markets continue to be volatile, but it makes a lot of sense as there are headlines coming from both London and Brussels I can move the market. Ultimately, this is a situation where if you are patient, you should make plenty of profit due to the longer-term uptrend that has been intact for quite some time.

EUR/GBP Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement