Advertisement

Advertisement

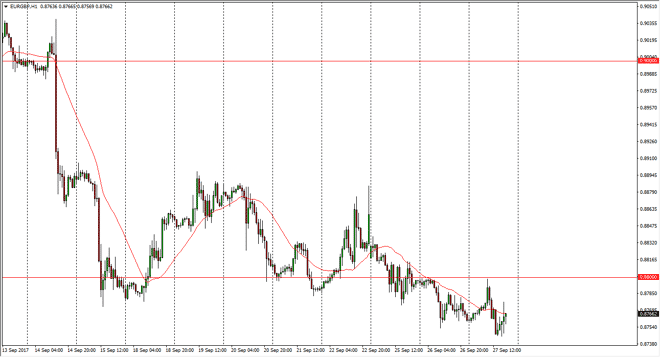

EUR/GBP Forecast September 28, 2017, Technical Analysis

Updated: Sep 28, 2017, 06:12 GMT+00:00

The EUR/GBP pair initially tried to rally during the day on Wednesday, but found the 0.88 level to be far too resistive. That’s an area where we have seen

The EUR/GBP pair initially tried to rally during the day on Wednesday, but found the 0.88 level to be far too resistive. That’s an area where we have seen a lot of interest in this market, and we have fallen significantly from there. I believe that the volatility continues, but overall, we have more of a negative proclivity in this market. If we did break above the 0.88 level, the market probably goes much higher, perhaps to the 0.90 level. In the meantime, I expect a lot of volatility is central banks around the world are readjusting their expectations of economic growth. This is a pair that tends to move very slowly, so keep that in mind as the trade that you take plays out.

I believe that we will go lower, but it isn’t going to be the easiest move. We will eventually break down towards the 0.86 level, but if we were to turn around and break above the 0.88 level on a daily chart, then I would have to acquiesce and start thinking about going long. The longer-term trend is up, but right now it appears that the Bank of England is far ahead of the European Central Bank when it comes to the raising of interest rates. However, with this divorce between the United Kingdom and the European Union, who knows what happens next? Ultimately, I think that you can count a lot of noise in this market but right now it appears for the time being that the sellers are flexing their muscles. I suspect that this will be a very noisy couple of sessions ahead of us as this market still looks a bit lost and directionless. That being said, patience will be needed for anything that you do.

EUR/GBP Video 28.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement