Advertisement

Advertisement

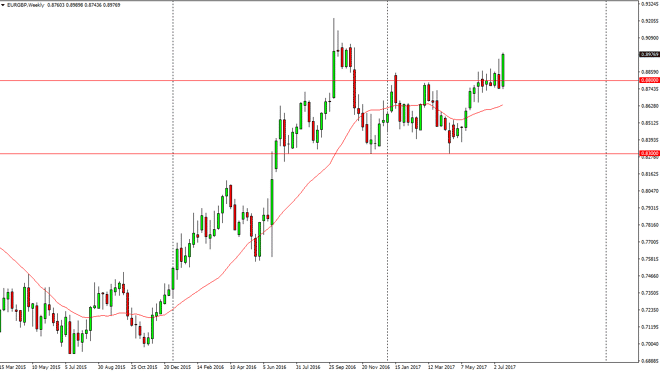

EUR/GBP forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:39 GMT+00:00

The EUR/GBP pair broke out to the upside during the week, slicing through the 0.88 level yet again. As we are closing towards the top of the candle, it

The EUR/GBP pair broke out to the upside during the week, slicing through the 0.88 level yet again. As we are closing towards the top of the candle, it looks likely that we are not only going to test the 0.90 level, but we may be able to break above it this time. Because of this, I think that the markets will look towards the 0.92 handle, and a break above there has this market looking towards the 0.95 level. I think pullbacks continue to offer buying opportunities, as the 0.88 level should continue to be a bit of a floor in the market, as it was so much in the way of resistance. I believe that the market continues to find buyers, and those buyers should continue to be looking at pullbacks as potential value in a situation that has been very bullish longer term.

Brexit

Looking at the market, it’s likely that headlines will continue to move this pair, and as we are still having quite a bit of struggle coming to the consensus needed for an amicable breakup between the European Union and the United Kingdom, it favors the EUR, as the trading community believes that the European Union will be in a stronger position down the road. However, there are a lot of different things happen between now and then, so I think that will continue to put a lot of volatility into this market. Human enough time, I think we do turn around but it looks to me as if we will go higher over the next several months. In fact, longer-term we could even be looking at a move towards parity, but there are so many unknowns between here and there that I find it difficult to aim for that currently.

EUR/GBP Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement