Advertisement

Advertisement

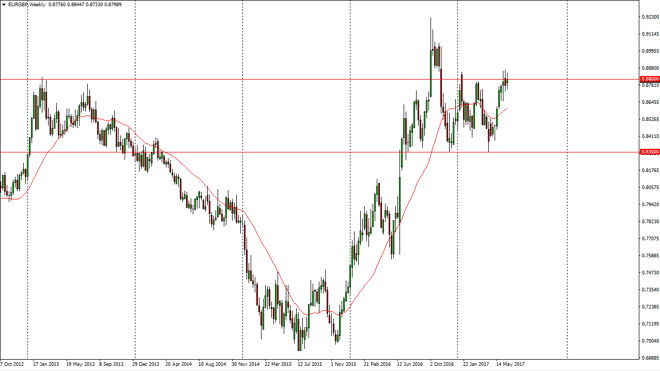

EUR/GBP forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:14 GMT+00:00

The EUR/GBP pair had a volatile week, as we continue to bang around the 0.88 handle. If we can break above the top of the candle, the market should then

The EUR/GBP pair had a volatile week, as we continue to bang around the 0.88 handle. If we can break above the top of the candle, the market should then go higher, perhaps reaching towards the 0.90 level which attracts a lot of volume. I believe that the pair is highly influenced by the headlines coming out of the negotiations from Great Britain leaving the European Union, but when I look at this chart I recognize that it seems very resilient in trying to break out, so I think sooner or later we will eventually get the bullish move necessary to move to that higher level.

Buying pullbacks

I continue to buy pullbacks, but I recognize that you may be better served by a picking up smaller positions on the pullbacks and waiting for the market to break out to a fresh high to put more money on the trade. I think that the 0.90 level makes sense, at least for the medium-term. If we can clear that area, then the market probably goes looking for the parity level after that. This pair tends to move rather slow though, so keep that in mind. You will have to think of this more as an investment than anything else, so keeping the leverage low might be exactly what’s necessary. In fact, if there was an ETF the traded this pair, I would be all about that move. Since there is in, the only thing you can do is control position sizing and recognize that hanging on to the trade may be exactly what is necessary, and therefore you should have plenty of time to add to that position. I believe that the trend is still higher until we would break down below the 0.83 handle.

EUR/GBP Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement