Advertisement

Advertisement

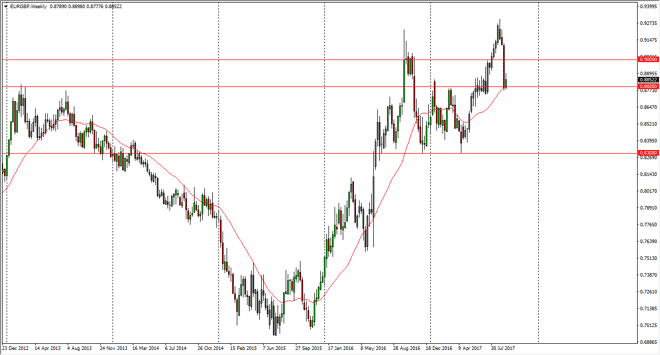

EUR/GBP forecast for the week of September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:07 GMT+00:00

The EUR/GBP pair found support at the 0.88 level, an area that I had mentioned previously. This is an area that has been resistive in the past, so it

The EUR/GBP pair found support at the 0.88 level, an area that I had mentioned previously. This is an area that has been resistive in the past, so it makes sense that it should be supportive now. We have seen a significant pullback in this market, and that of course suggests that the volatility will continue, and of course with the Bank of England looking likely to be forced to raise interest rates, it’s not a huge surprise that we did fall. However, I think there are other forces at work here, not the least of which will be the United Kingdom leaving the European Union. There will continue to be headlines out there pushing the market’s around, and signs of European strength will certainly be attractive for currency traders.

Longer-term, we are in a significant uptrend, and even with the recent pullback that has not changed. I think we will probably try to bounce towards the 0.90 level, but if we break above there, the market should continue to go much higher. Ultimately, I believe that the market should continue to move back and forth, and I think that if we do break down below the 0.87 level, then we may see a significant pullback going forward. Currently though, it looks as if the buyers are trying to make a stand so it’s probably easier to trade this market from a shorter-term perspective than a longer-term perspective. I still believe in the uptrend, but I do recognize that we have had a jolt to the market. If we were to break down below the 0.83 level, which is the next major support level, then I think the uptrend is essentially dead as it would show a significant break down.

EUR/GBP Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement