Advertisement

Advertisement

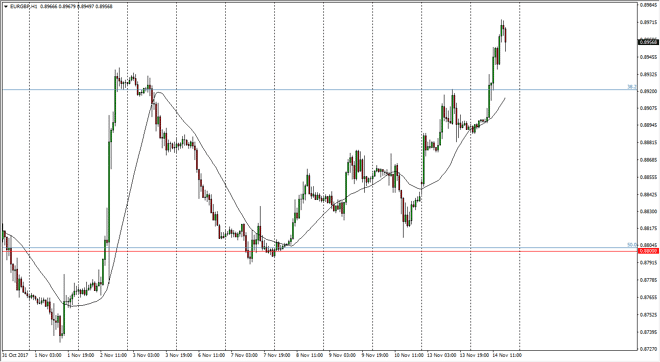

EUR/GBP Price Forecast November 15, 2017, Technical Analysis

Updated: Nov 15, 2017, 05:30 GMT+00:00

The EUR rallied significantly during the trading session on Tuesday, breaking above the 0.89 handle. This is a very strong sign, and I believe that the

The EUR rallied significantly during the trading session on Tuesday, breaking above the 0.89 handle. This is a very strong sign, and I believe that the market is likely to pull back a bit to find buyers near that handle again. Ultimately, the market should continue to go towards the 0.90 level above, which has been very important over the longer-term charts. I think we will not only reach towards that area, but we will break above there and continue to go much higher, perhaps to the 0.93 level which had been the recent all-time high. I think that the market will continue to be volatile due to the negotiations between the European Union and the United Kingdom of course, but longer-term it looks as if the uptrend is very much intact. As we have recently made a “higher high”, it looks as if the overall trend is continuing to follow to the upside.

I do think that the 0.89 level will be supportive, and of course the 0.88 level will be as well, as it has been important on longer-term charts in the past. The European Union represents a bit more stability than the United Kingdom currently, and therefore the markets will more than likely favor the EU. Beyond that, the EUR/USD pair has broken above the 1.17 level, which was the neckline of the head and shoulders on the pair, and that negates what would have been a very negative sign for the EUR in general. Overall, I remain bullish, but I also recognize that we will be very noisy, so keep that in mind as we will need to be very careful with position sizing as the market could get very volatile occasionally as headlines will dominate flow in the pair..

EUR/GBP Video 15.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement