Advertisement

Advertisement

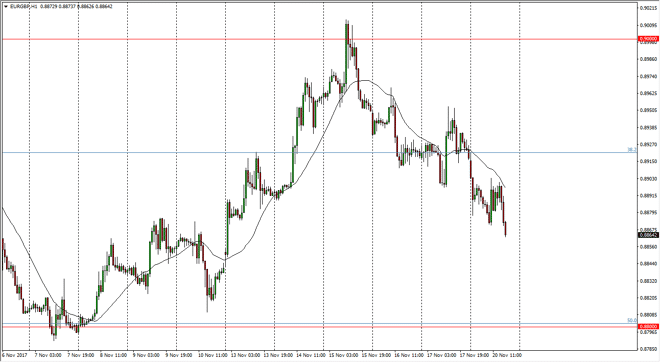

EUR/GBP Price Forecast November 21, 2017, Technical Analysis

Updated: Nov 21, 2017, 05:02 GMT+00:00

The EUR/GBP pair fell during the day on Monday, dropping down towards the 0.8880 level, and then went sideways in a violent back and forth manner on the

The EUR/GBP pair fell during the day on Monday, dropping down towards the 0.8880 level, and then went sideways in a violent back and forth manner on the hourly chart. We then fell again, and it looks as if we are ready to drop towards the 0.88 level underneath. That area has been important more than once, and as I had stated on Friday, I thought that we could perhaps be ready to enter consolidation again, with the 0.88 level offering massive support, and the 0.90 level above offering significant resistance. Because of this, I believe that we will drift towards the 0.88 level yet again, but historically this has been an area where buyers are willing to step back into the marketplace.

I’m looking for some type of bounce from the 0.88 level to start buying, and I believe that the market will offer an opportunity to go to the 0.90 level. Once we reach that area, I will look to the stochastic oscillator as a secondary indicator, offering the signs of oversold momentum, and then start buying again. I don’t know if we can break above the 0.90 level this next time, but I do think we eventually will as there is much more faith in what’s going to happen in the European Union than the United Kingdom after the split. However, with so much in the way of headline driven noise, it would make sense that we would have to consolidate yet again. There is no clear direction quite yet, but once we get it this pair could move rather drastically. A lot of pundits that I speak to still believe that we will eventually see the parity level tested once we get some type of resolution on the break up.

EUR/GBP Video 21.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement