Advertisement

Advertisement

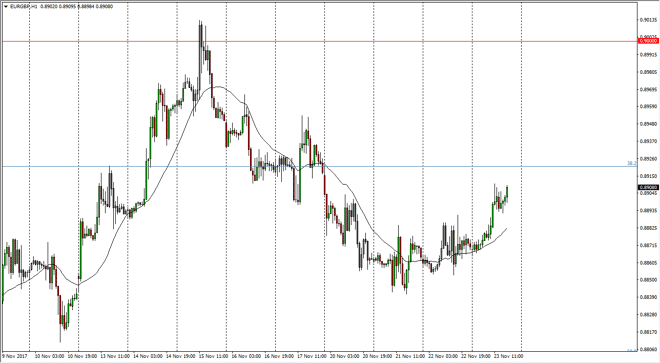

EUR/GBP Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:04 GMT+00:00

The EUR/USD pair rally during the trading session on Thursday, reaching towards the 0.89 handle. A break above there should send this market towards the

The EUR/USD pair rally during the trading session on Thursday, reaching towards the 0.89 handle. A break above there should send this market towards the 0.90 level again, as it is the top of the larger consolidation area that we have been trading in. A break above the 0.90 level is a very bullish sign and should send this market to the 0.93 handle. I like buying pullbacks, because quite frankly it offers value in a currency pair that has been very strong. I recognize that the European Union is quite a bit more stable in the eyes of traders, as the United Kingdom has a bit less clarity when it comes to the future. I think that is one of the main drivers of this pair, and this recent pullback has been a nice opportunity to pick up value. However, I think that we will probably struggle to break above the .90 level, as we have been in consolidation, and is very likely that the uncertainty will continue to be a major issue, keeping traders of out of the market in general.

The 0.88 level underneath is massively supportive, and it’s not until we break down below there that I would be concerned about the consolidation or the uptrend. That’s an area that has been important several times, and I think it should continue to be the case. If we were to break down below there though, the 0.86 level would be the next target as it was supportive in the past. In general, this is a market that continues to show quite a bit of volatility, but more importantly for me: it shows value on dips and therefore that’s how I’m going to continue to trade with an eye to the upside.

EUR/GBP Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement