Advertisement

Advertisement

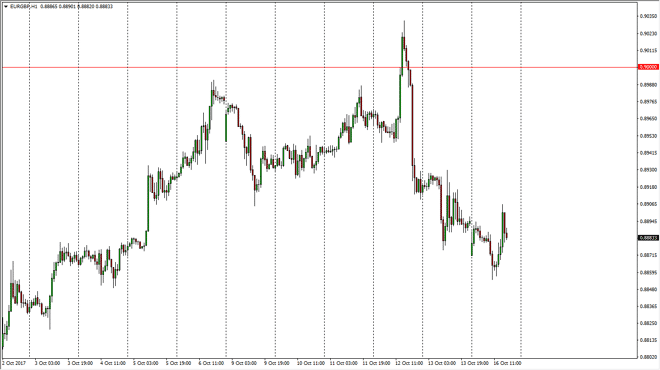

EUR/GBP Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 06:00 GMT+00:00

EUR/GBP continued to drift lower during the session on Monday, but we found a bit of support at the 0.8850 level. Ultimately, I think that the major

EUR/GBP continued to drift lower during the session on Monday, but we found a bit of support at the 0.8850 level. Ultimately, I think that the major support is near the 0.88 level underneath, which is a major round number. I think that the market should continue to find buyers in that area if we do drop down to their, but quite frankly I think that the markets will eventually go looking towards the 0.90 level above. If we can break above that area, the market should continue to go to the 0.92 level after that. Ultimately, this is a very volatile market, but I think that the markets will continue to favor the Euro, although the Bank of England looks likely to raise interest rates. Keep in mind that people are more comfortable investing in the European Union and then they are the United Kingdom, so it makes sense that the currency continues to rally. That’s not to say that it will be a straight shot higher, just that overall and longer-term I think that the buyers will be victorious. Ultimately, pullbacks offer value that traders will take advantage of.

If we did breakdown below the 0.88 level, that could change things from a longer-term standpoint, as I suspect we will drop towards the 0.85 level after that. Overall though, this is a market that should continue to see a lot of noise, but if you are longer-term incline, it is a market that should eventually go looking towards the parity level. I think that will take several months at this rate, but I do expect to see parity sometime early 2018. In the meantime, I continue to buy dips in small quantities until we break down below the 0.88 handle.

EUR/GBP Video 17.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement