Advertisement

Advertisement

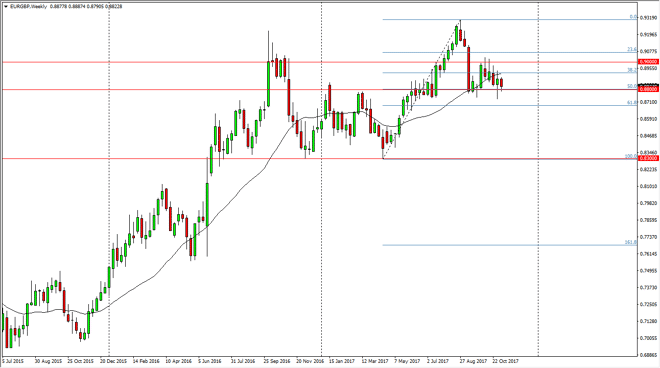

EUR/GBP Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:10 GMT+00:00

The EUR/GBP pair drifted a bit lower during the week, testing the 0.88 level. That area has offered a bit of support, and with the hammer from the

The EUR/GBP pair drifted a bit lower during the week, testing the 0.88 level. That area has offered a bit of support, and with the hammer from the previous week, I think that we could find buyers in this region. Beyond that, it is the 50% Fibonacci retracement level of the recent search higher, and when you look at the longer-term charts, we had made a “higher high.” Ultimately, I believe that this market continues to find bullish pressure, because the one thing that currency traders hate more than anything else is uncertainty. While nobody is predicting the demise of the United Kingdom, it is much more certain what will happen in the European Union over the next couple of years than in the UK, so that naturally puts a little bit of a bid under this pair.

I believe that the market has a hard floor down at the 0.83 level, so if we were to break down below the hammer from the previous week, that’s probably the next target. Overall though, I believe that the buyers are going to continue to jump into this market place, and perhaps keep this market consolidating between the 0.88 and the 0.90 level over the next several weeks. Once we break above the 0.90 level, then we are free to go much higher. I think currently we are just simply trying to build up a little bit of momentum to continue the overall uptrend, and sometimes that takes a while. That will be especially true in currency pairs like this one that can be so heavily influenced by headlines, in this case coming out of both London and Brussels. Expect volatility, but remember this pair can move in slow motion at times.

EUR/GBP Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement