Advertisement

Advertisement

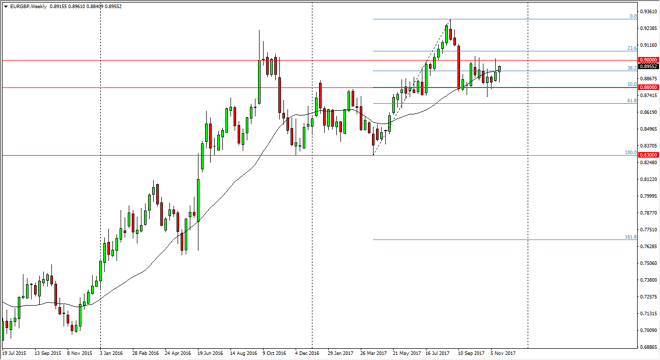

EUR/GBP Price forecast for the week of November 27, 2017, Technical Analysis

Updated: Nov 25, 2017, 05:20 GMT+00:00

The EUR/GBP pair continues to be very volatile, bouncing around in a tight range yet again. It looks as if the 0.88 level underneath is going to continue

The EUR/GBP pair continues to be very volatile, bouncing around in a tight range yet again. It looks as if the 0.88 level underneath is going to continue to be supportive, while the 0.90 level above is resistance. The weekly candle is a bit of a hammer, and if you look at the bodies of the candles over the last several weeks, you can see that the market is forming a basing pattern, or what is sometimes called a rounding pattern. If we can break above the 0.90 level, the market should continue to go higher, perhaps reaching towards the 0.93 level after that. That area has caused quite a bit of resistance in the past, but I think that we will eventually go looking towards that, as we have found significant support at what would be the 50% Fibonacci retracement level from the larger move to the upside.

The situation in negotiations between London and Brussels will continue to have a massive effect on this pair, and I think that headlines will continue to make things very choppy. In general, I believe in the upside though, because quite frankly most traders will think of the European Union as being a bit more stable than the United Kingdom, as we do not know how things are going to end up with the UK after leaving the EU. Traders love certainly, and absolutely run from uncertainty, and therefore think we will continue to see bullish pressure in general. If we can break above the 0.93 level, then we will see the market go to the 0.95 level next. Pullbacks continue to be buying opportunities, and at this point I look at them as value. Longer-term, a lot of traders are looking at parity as a possibility.

EUR/GBP Video 27.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement