Advertisement

Advertisement

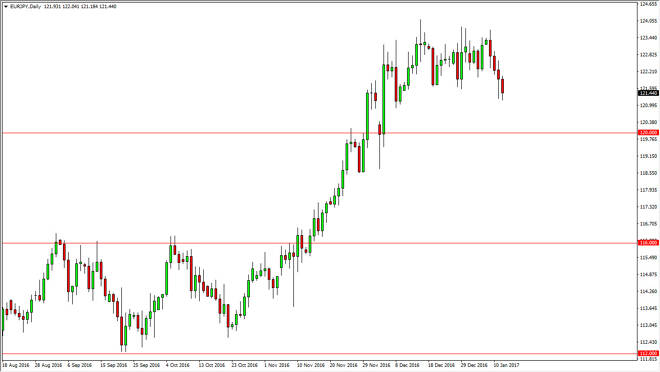

EUR/JPY Forecast January 13, 2017, Technical Analysis

Published: Jan 13, 2017, 04:40 GMT+00:00

The Euro fell against the Japanese yen initially on Thursday, reaching towards the 121 handle. However, we have been in a longer-term uptrend for some

The Euro fell against the Japanese yen initially on Thursday, reaching towards the 121 handle. However, we have been in a longer-term uptrend for some time, and even though we have broken down a bit I recognize that the real support probably sits closer to the 120 handle below. With this type of action, I think the market is trying to build up enough momentum to go higher, and continue the longer-term uptrend. This is a market that continues to show quite a bit of volatility, as the Japanese yen typically does, but quite frankly I do think that the Bank of Japan and its ultra-easy monetary policy will continue to work against the value of the Yen anyway, and that is what this pair is following.

The EUR/JPY pair tends to be very risk sensitive, meaning that as stock markets go higher, so does this pair, at least that’s historically been the case. The move higher isn’t necessarily anything to do with the Euro, but more a reflection on what people think about the Yen currently. Because of this, I think that all the yen related pairs will continue to see upward pressure, and the EUR/JPY pair won’t be an exception.

If we do fall from here, I believe that the 120 level will be massively supportive, and will attract a lot of attention. I look at pullbacks as value that you can take advantage of, and that’s exactly what I plan on doing: taken advantage of this opportunity. After all, we have seen a massive move higher over the last couple of months, so the fact that we would grind sideways or even perhaps drop a bit doesn’t exactly change the overall attitude of a market that has broken out to the upside in exploded higher.

Granted, the Euro may or may not be the most explosive currency against the Japanese yen, but it is another major currency, and that gives us a certain amount of stability when it comes to trading against the Japanese yen. For example, most of you probably don’t follow the Turkish lira, but it’s absolutely collapsing against the Japanese yen while everything else is strong. In that sense, sometimes it’s easier to simply take the straightforward and simple trade.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement