Advertisement

Advertisement

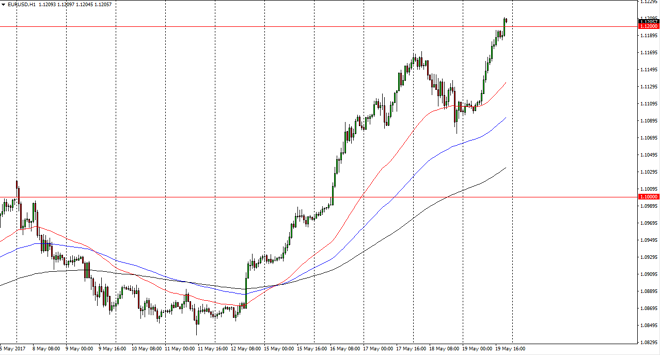

EUR/USD Forecast May 22, 2017, Technical Analysis

Updated: May 20, 2017, 04:30 GMT+00:00

The EUR/USD pair had a very strong session on Friday, breaking above the 1.12 level. This is a very bullish sign, as American traders will went home for

The EUR/USD pair had a very strong session on Friday, breaking above the 1.12 level. This is a very bullish sign, as American traders will went home for the weekend they started buying the EUR yet again. This shows a real confidence in the EUR, and perhaps the “risk on” trade is going to continue. Because of this, I believe that buying dips will continue to be the way going forward, although I recognize there is a lot of noise just above. Longer-term, the market is probably going to go looking for the 1.15 level but we will have times where the market pulls back rather significantly. Think of those is value, as it appears that the market is ready to continue driving higher. The last several sessions have been very bullish for the Euro, and I think that might be the overall trend, but we may need to cool off in this area for the short term.

Buying on the dips

I believe the buying on the dips is about the only strategy you can implore, because quite frankly we have gone fairly far and a short amount of time. That shows that the momentum is on the side of the buyers, but that momentum doesn’t last forever. As we pull back, I think that there will be several areas that the buyers could return. The 1.1150 level is an ideal level, just as the 1.11 level is. Having said that, we’ll have to see what the Asians do but I suspect that every time we pull back there will be a significant amount of value to be gleaned from the market. I don’t know if we can break above the 1.15 level, because that is the top of the three-year consolidation area that we have been trading in.

EUR/USD Video 22.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement