Advertisement

Advertisement

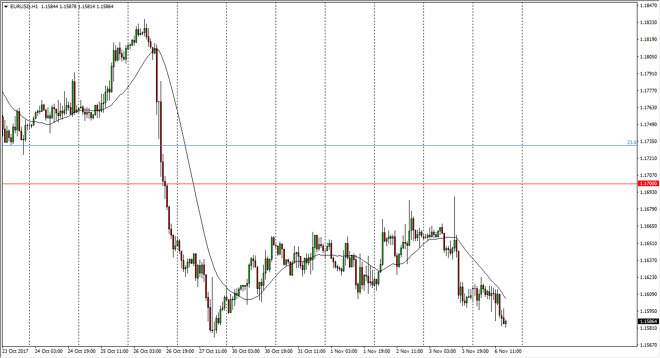

EUR/USD Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 07:05 GMT+00:00

The EUR/USD pair has rolled over a bit during the day on Monday, as we continue to reach towards the lows recently set in the market. Ultimately, the 1.17

The EUR/USD pair has rolled over a bit during the day on Monday, as we continue to reach towards the lows recently set in the market. Ultimately, the 1.17 level underneath should continue to be massively resistive, as it was the neckline of the head and shoulders pattern on the daily chart. I think that rallies continue to offer selling opportunities, and I look for exhaustion to go lower. If we were to break down to a fresh, new low then I think that the market will continue to reach down towards the measured move from the head and shoulders pattern, the 1.13 level. That is the 50% Fibonacci retracement level of the search higher, towards the 1.21 level. There are a couple of different reasons to suspect that this market will find buyers below, but in the meantime, it does offer and I selling opportunity.

The Federal Reserve continues to have its influence obviously, and with the interest rate hikes that we are going to be seen later this year, it’s likely that the US dollar will be favored. This will also be exacerbated by any “risk off” attitude that the markets develop, and quite frankly with a lot of concerns coming out of the Saudi Arabian purge over the weekend, and of course the almost daily North Korean issue, it would not surprise me at all to see a run to the US dollar in general. If that’s the case, I think that the move is almost self-fulfilling.

If we were to break above the 1.17 level on a daily close, then that would negate all the negativity, and I think we would probably go looking towards the 1.21 level yet again. If we can break above there, then the market should continue to be a “buy-and-hold” situation. However, it’s very unlikely in the short term.

EUR USD Forecast Video 07.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement