Advertisement

Advertisement

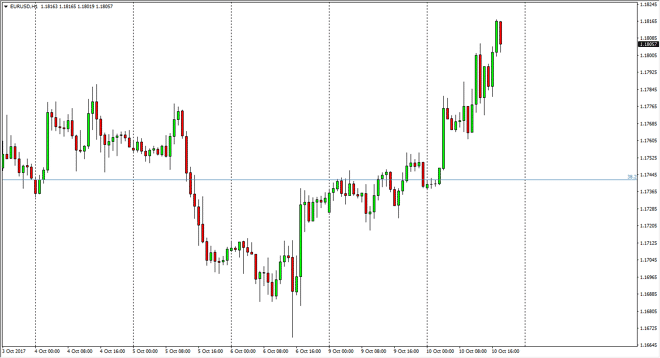

EUR/USD Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 05:28 GMT+00:00

The EUR/USD pair continued to grind to the upside during the day on Tuesday, breaking above the 1.18 level. It now looks as if the market is ready to

The EUR/USD pair continued to grind to the upside during the day on Tuesday, breaking above the 1.18 level. It now looks as if the market is ready to continue reaching towards the 1.20 level above, which was significant resistance. I think that it is going to be very noisy, and of course with the FOMC Meeting Minutes coming out during the day today, this could have a great influence as to where the US dollar goes next, and that of course is going to show itself here in this pair. I think that longer-term the uptrend will continue, and I do think that eventually we will break out above the 1.21 handle. By clearing that, we can continue to go to the 1.25 level above, which was my longer-term target. After all, we have broken out above the 1.15 level previously, which was a very bullish sign. This was a consolidation area that we broke out from 3 years of choppiness, and that has us looking for a longer-term move.

However, the market pulling back was a healthy sign, as we continue to see volatility, and this should have people looking for value in a market that has now shown itself to be choppy, but at the end of the day I think that the buyers breaking out of the consolidation should lend itself to longer-term buying pressure. I still believe that we go to the 1.25 handle, but it’s obviously going to take a lot of work to get there. By going long on short-term pullbacks, you have the ability to profit several times. Alternately, I think that if we were to go lower, I will simply wait on the sidelines for an opportunity. I don’t have any interest in shorting this market now, just because we have seen such a significant bounce from the 1.1675 region.

EUR/USD Forecast Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement