Advertisement

Advertisement

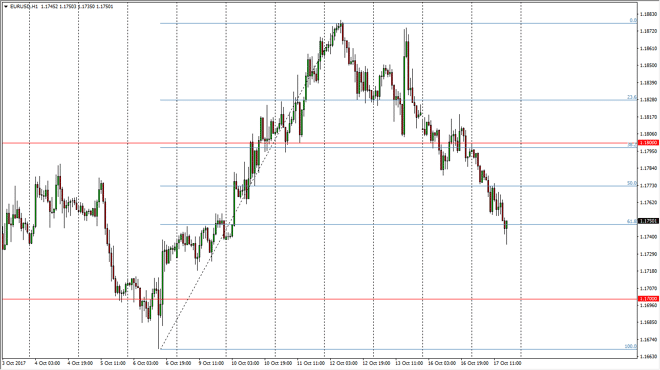

EUR/USD Forecast October 14, 2017, Technical Analysis

Updated: Oct 18, 2017, 05:01 GMT+00:00

The EUR/USD pair fell rather significantly during the day on Tuesday, reaching down to the 1.1750 level underneath. This is an area where we have seen

The EUR/USD pair fell rather significantly during the day on Tuesday, reaching down to the 1.1750 level underneath. This is an area where we have seen resistance previously, so it makes sense that we would see support again. The 61.8% Fibonacci retracement level is right here as well, so I like the idea of buying this dip as it represents value. I think there is plenty of support down to at least the 1.17 level underneath, so therefore I think it’s very likely that the market is going to bounce from here, perhaps reaching towards the 1.18 level above. A break above that level should send this market much higher, perhaps reaching towards the 1.19 level again. Longer-term, I think that the market goes looking towards the 1.20 level, as it is a longer-term level that the market has been paying attention to for some time.

I like buying dips, I don’t have an interest in shorting as we have seen such bullish pressure to the upside over the last several weeks and months. I don’t think that is can be an easy market to trade, but certainly looks very likely that the market will continue to look at dips as value, and it makes sense that the trading community overall will continue to look at the market as one that should be bought and not sold, and I believe that the Federal Reserve, although hawkish, is taking a backseat to the European Central Bank and the economic recovery in the European Union.

If we break out to the upside, clearing the 1.21 level, the market then continues towards the 1.25 level, which was the projected target after breaking above the top of the ascending triangle several weeks ago. Volatility continues, but with an upward twist.

Euro to Dollar Forecast Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement