Advertisement

Advertisement

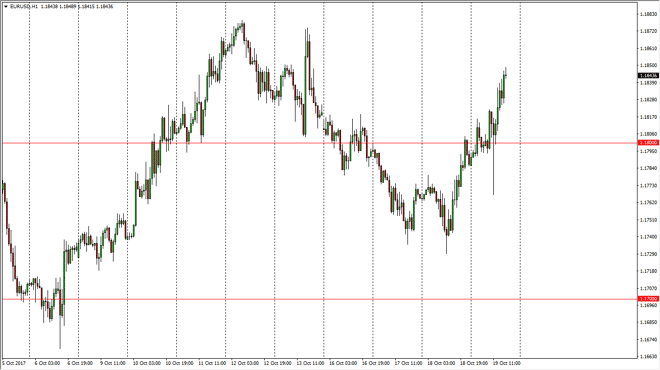

EUR/USD Forecast October 20, 2017, Technical Analysis

Updated: Oct 20, 2017, 06:00 GMT+00:00

The EUR/USD pair went sideways initially during the day on Thursday, but then did dip at one point. It appears that traders like the idea of Spain taking

The EUR/USD pair went sideways initially during the day on Thursday, but then did dip at one point. It appears that traders like the idea of Spain taking control of Catalonia, as they have bought the EUR Hanover fist since then. The 1.18 level should offer support, and I think it’s only a matter of time before the markets go to the 1.19 handle. Ultimately, this is a market that has been trending higher for some time, and it makes sense that we should continue to find buyers. I don’t have any interest in shorting this market, as I think that the psychologically important 11.20 level is the target, and it’s only a matter of time before we go looking towards that level. This is an area that has been resistive in the past, but should give way eventually. I think we been trying to build up enough momentum to take that level out, but it’s obviously going to take something special to have that happen.

Buying dips

I think that buying dips continues to be the best way to trade this market, and I now look at the 1.18 level as potential floor. The market will probably find the 1.19 level above as resistive as well, but that should be a short-term thing as it is more of a psychological barrier than anything else. After all, we’ve gone through there are a couple of times recently. If the markets continue to feel “risk on”, this pair should rally as well, so pay attention to the stock markets around the world at the start to recover, that could be a sign that we go higher here as well. Selling is not a thought, and I believe that any time we do fall, it’s only a matter of time before value hunters appear.

EURUSD analysis Video 20.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement