Advertisement

Advertisement

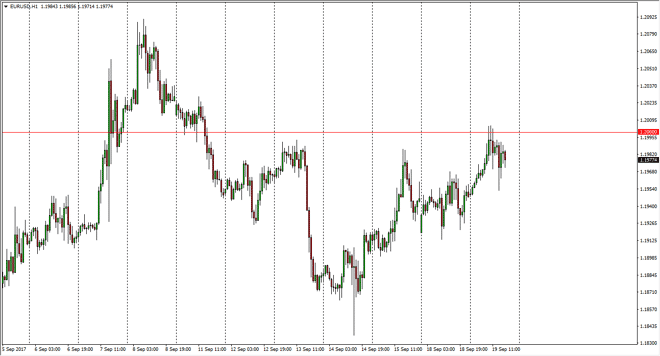

EUR/USD Forecast September 20, 2017, Technical Analysis

Updated: Sep 20, 2017, 04:52 GMT+00:00

The EUR/USD pair rallied on Tuesday, testing the 1.20 level. This is an area that should continue to offer a bit of resistance, but with the Federal

The EUR/USD pair rallied on Tuesday, testing the 1.20 level. This is an area that should continue to offer a bit of resistance, but with the Federal Reserve looking likely to not be able to raise interest rates after the hurricanes, I suspect that this market will probably continue to go higher. Short-term pullback should be buying opportunities, and I believe that the market break above the 1.21 level above should send this market finally reaching towards the 1.25 handle above. That is my longer-term target going forward as the recent breakout measured for that move. I believe that the EUR will continue to be favored over the US dollar as the ECB looks likely to cut back on quantitative easing going forward, and of course the Federal Reserve has a lot of issues on his plate it wants. Although I believe that the Federal Reserve will eventually raise interest rates as well, I believe that the interest rate differential will eventually favor the Europeans, just as most of the market seems to as well.

Buying dips

I believe that buying dips continues to be the way forward, as the market ultimately should look at the 1.1950 level underneath for support, and possibly even at the 1.19 level. With this, I think that it will be choppy, this pair tends to be, but given enough time I do think that the buyers will win. In fact, it’s not until we break down below the 1.18 level that I would consider this market in trouble, and even then, I think that there is plenty of support near the 1.15 handle. Ultimately, I believe that being patient and waiting for signs of life will be the way to go. I think that the Federal Reserve may say just enough to send this market to the upside.

EUR/USD Forecast Video 20.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement