Advertisement

Advertisement

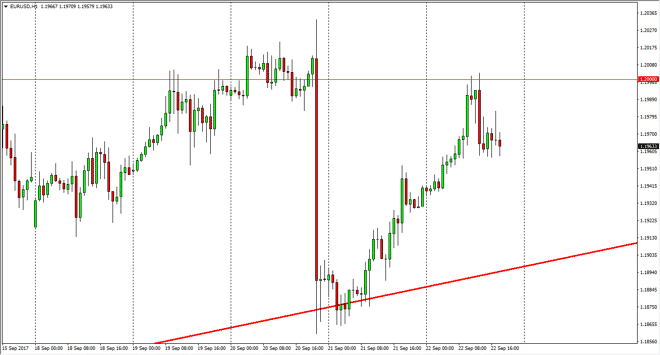

EUR/USD Forecast September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:14 GMT+00:00

The EUR/USD pair initially shot higher during the day on Friday, but found the 1.20 level to be too resistive to continue going higher. This area has

The EUR/USD pair initially shot higher during the day on Friday, but found the 1.20 level to be too resistive to continue going higher. This area has continued to offer problems for the market, and I think that we may be running into an area that the market cannot overcome in the short term. I think a pullback is probable, but quite frankly I think it’s a buying opportunity for longer-term traders. When you look at the weekly chart, we have done a bit parabolic and I think that this suggests that the pullback will be necessary to find the proper momentum to finally smash through the 1.20 level. I do have a longer-term target of 1.25, but it’s going to take a while to get there and we have been relatively parabolic. Parabolic moves typically get significant pullbacks and in short order, but eventually tend to prove themselves to be correct. I think we are entering an area that could signal that we are pulling back looking for value.

Short-term selling only

I think that at best, you can sell this market for the short term, as there are a lot of support levels just below. Most notably for me is the 1.1850 level, which served as a bit of a floor a couple of days ago. If we were to break down below there, then we could pick up speed to the downside. I believe that the absolute “floor” in the market is closer to the 1.15 handle, so we could have a way to go before the buyers overwhelm again. Ultimately though, I think that this is a function of a market that has gotten ahead of itself, and simply needs to pull back to find enough people willing to take it seriously.

EUR/USD Video 25.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement