Advertisement

Advertisement

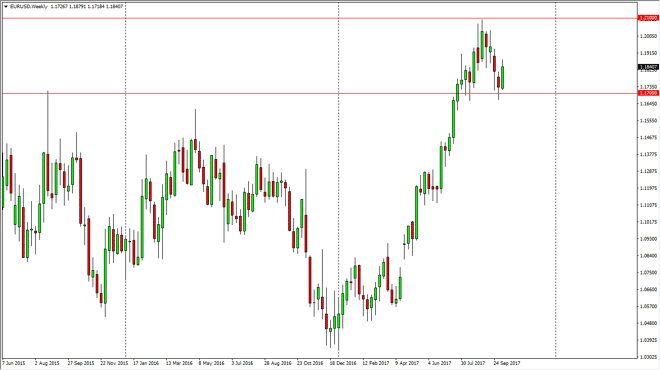

EUR/USD forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:37 GMT+00:00

The EUR/USD pair had a rally during the course of the week, using the 1.17 level as support. By bouncing the way we did, we broke above the top of the

The EUR/USD pair had a rally during the course of the week, using the 1.17 level as support. By bouncing the way we did, we broke above the top of the hammer from the previous week, and it looks likely that we are going to bounce around overall, with the 1.17 level underneath being massive support. I think that we will go looking towards the 1.21 handle again, as we have been in a very strong uptrend. However, when you look back over the totality of the year, we have rallied rather significantly and more importantly: in a parabolic manner. Ultimately, the market should continue to see buyers underneath, but I think that eventually the real fight will be closer to the 1.21 level. If we can break above there, then we can continue to go to the 1.25 level. After all, we had recently broken out of a major consolidation area that should measure for a move to the 1.25 handle.

Continuing to buy dips

I believe that buying dips will continue to be the way in the EUR/USD pair, as we should eventually go for the 1.25 handle that I mentioned. I don’t think it’s going to be easy, and I think that a lot of volatility can be expected. After all, there are a lot of shifting expectations when it comes to the Federal Reserve raising interest rates, and of course more importantly, the European Central Bank tightening monetary policy continues to drive this market to the upside. Ultimately, the market should continue to favor the EUR in general, and that is what we are looking at one we look at the chart. Selling isn’t even a thought until we break down below the 1.15 handle.

EUR USD Forecast Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement