Advertisement

Advertisement

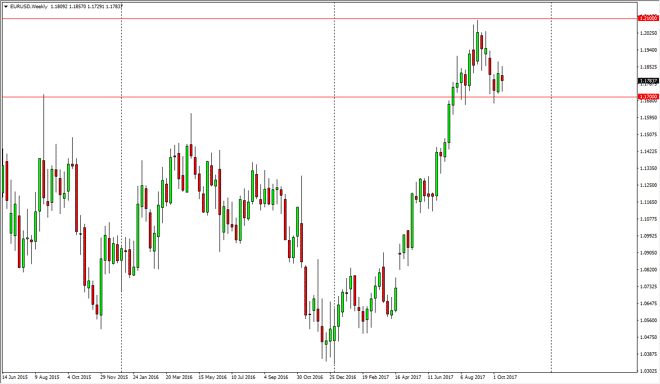

EUR/USD forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:40 GMT+00:00

The EUR/USD pair went back and forth during the week, testing the 1.17 level underneath for support, but also rallying enough to test the 1.19 level. It

The EUR/USD pair went back and forth during the week, testing the 1.17 level underneath for support, but also rallying enough to test the 1.19 level. It is because of this that we had formed a bit of a neutral candle, and I think we are trying to decide where to go next. If we break down below the 1.17 level, I suspect that the market is connected down to the 1.15 handle at that point. However, we are in a market that has been in an uptrend for some time, and if we break above the 1.19 level, I think we will make another attempt at the massive resistance barrier at the 1.20 level that extends to the 1.21 handle. A break above there frees the market to fulfill my longer-term target of 1.25 that is based upon the breaking out of massive consolidation over the last couple of years.

All things being equal, this is a market that has been rather impulsive to the upside, and consolidation at the very least is probably what would be needed to continue the longer-term move to the upside. Because of this, I believe that short-term traders will continue to be somewhat bearish, but we are most certainly in an uptrend, so I think that longer-term traders are simply biding their time to find some type of reason to go long and perhaps looking at pullbacks as potential value. Ultimately, I believe that the market will find plenty of buyers, but significant amount of patience will be needed. I think that we are about to see several busy and noisy weeks ahead, so small positions are probably what will serve you best, and then perhaps adding as the trade goes in your direction.

EUR USD Forecast Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement