Advertisement

Advertisement

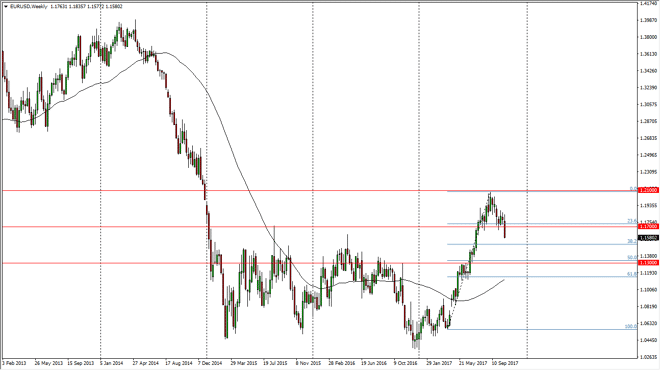

EUR/USD forecast for the week of October 30, 2017, Technical Analysis

Updated: Oct 28, 2017, 11:56 GMT+00:00

The EUR/USD pair initially tried to rally during the week but then broke down significantly. This accelerated on Thursday, as Mario Draghi suggested that

The EUR/USD pair initially tried to rally during the week but then broke down significantly. This accelerated on Thursday, as Mario Draghi suggested that the European Central Bank would continue to extend its quantitative easing program, although at a slower pace. However, this is more dovish than hawkish, and of course of the same time we have the Federal Reserve looking to raise interest rates over the next several months, and that continues to put bullish pressure on the US dollar. I think that the 1.13 level will probably be targeted underneath, as it is the 50% Fibonacci retracement level, and of course on the daily chart we have seen a head and shoulders breakdown, which measures to that level. I believe that the market needs to cool off after the massive move to the upside, and it makes sense that this pullback happens, as it could give us a bit of value in the Euro longer term.

Over the next couple of weeks, I expect the selling pressure to continue, and it’s not until we break above the 1.18 level that I would be comfortable buying. That is unless of course we get down to the 50% Fibonacci retracement level and form some type of supportive candle. At that point, the market should reach back towards the 1.17 above. A breakdown below the 1.13 level has this market breaking down significantly. I suspect that probably won’t happen though, and that this pullback will be looked upon by longer-term chart readers as a necessary building up momentum to continue to the upside longer term. Volatility will continue to be a significant problem, so keep your position size somewhat small. Overall, this moved to the downside as well within normality.

EUR USD Forecast Video 30.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement