Advertisement

Advertisement

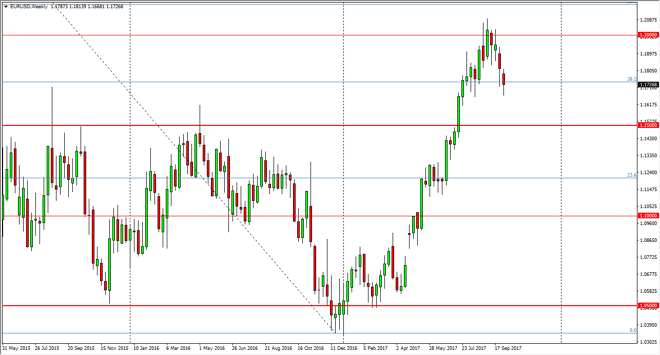

EUR/USD forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 07:00 GMT+00:00

The EUR/USD pair had a very negative week, reaching below the 1.17 level but as we close down the week on Friday, it looks like buyers were starting to

The EUR/USD pair had a very negative week, reaching below the 1.17 level but as we close down the week on Friday, it looks like buyers were starting to step back in, and this of course was an area where we had seen buyers in the past. I think if we can break above the top of the weekly candle, the market is likely to go looking towards the 1.20 level above. That level has been resistance in the past, extending all the way to the 1.21 handle. Once we break above there, we can finally fulfill the suggested move from the breakout that measured towards the 1.25 handle. That happened once we broke above the 1.15 level, and it’s likely that the volatility should continue, but I don’t see the reason why we won’t go towards that region. That’s not to say it’s going to happen anytime soon, but it certainly will happen eventually.

If we did happen to break down below the 1.15 handle, then I think the market will collapse and trying to fill the gap below at the 1.08 level. That would be a very negative turn of events, but it’s unlikely to happen. Having said that, you should always keep an eye on the alternate scenario, and that most certainly is it. This market continues to focus on several moving parts, not the least of which is the Federal Reserve, as the interest rate picture starts to look a bit more hawkish in America, but the question then remains as to how many interest rate hikes there will be. It appears that the European Union is starting to strengthen, and as markets are forward-looking and vehicles, and makes sense that they start to favor the EUR early.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement