Advertisement

Advertisement

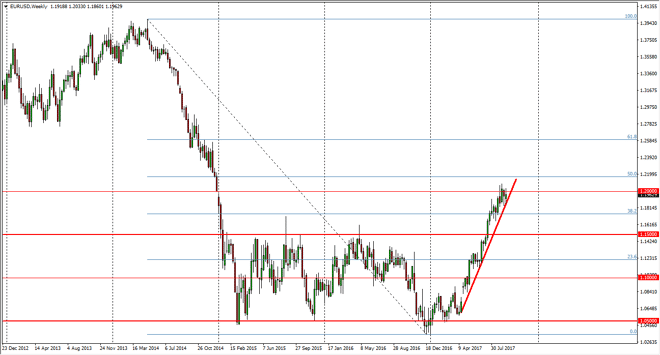

EUR/USD forecast for the week of September 25, 2017, Technical Analysis

Updated: Sep 23, 2017, 07:14 GMT+00:00

The EUR/USD pair has been very parabolic over the last several months, as we are currently testing the 1.20 level. If we can finally break above there on

The EUR/USD pair has been very parabolic over the last several months, as we are currently testing the 1.20 level. If we can finally break above there on a weekly close, I feel that the market is ready to go much higher. Based upon the breakout of recent consolidation that we have seen, I believe that the longer-term target is the 1.25 level above, which happens to be a large cluster. All of this adds up quite nicely, but we are bit overextended. Because of this, I think that a pullback makes sense, and should be a buying opportunity for longer-term traders. I believe that the 1.15 level underneath should be a massive support, and that if we can stay above that level, we will continue to rally.

With the ECB looking more hawkish than in the past, we could see a bit of a jolt higher, especially based upon words of potential interest rate hikes. I don’t think we are there yet, but quite frankly markets tend to try to predate any action by about 6 months, and I think that’s what we are seeing. The 1.25 level should of course be massively resistive, but I think given enough time will probably break above there as well, if the world’s economy can pick out. If we get some type of “risk off” event, then we could roll over and reach towards the 1.15 level again. North Korean tensions can have money flowing into US dollars, although I think this will be muted at best and less of course we see even more aggressive action out of the players in that story. Overall, this is a market that is very bullish, so from the longer-term perspective I would have no interest in selling anytime soon.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement