Advertisement

Advertisement

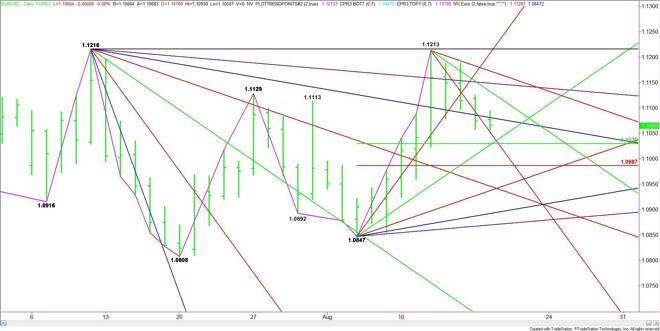

EUR/USD Mid-Session Technical Analysis for August 18, 2015

By:

Daily EUR/USD Technical Analysis The EUR/USD is trading lower at the mid-session. The market is trading on the weak side of a long-term downtrending angle

Daily EUR/USD Technical Analysis

The EUR/USD is trading lower at the mid-session. The market is trading on the weak side of a long-term downtrending angle and testing another steep downtrending angle.

The main trend is up according to the daily swing chart, but momentum is clearly to the downside. The main range is 1.0847 to 1.1213. Its retracement zone at 1.1030 to 1.0987 is the primary downside target.

The nearest resistance angle is at 1.1081. Crossing to the weak side of the downtrending angle at 1.1053 will indicate the selling is getting stronger. This should trigger a break into a potential support cluster at 1.1030 to 1.1027.

Watch for a technical bounce on the first test of 1.1030 to 1.1027. If it fails to hold then look for an acceleration to the downside into the Fibonacci level at 1.0987. Given the current volatility, it may take a couple of days to reach this level.

Based on the current price at 1.1058, the direction of the market the rest of the session is likely to be determined by trader reaction to the angle at 1.1053. Holding it could create enough upside momentum to fuel a rally back to 1.1081. A sustained move under 1.1053 is likely to trigger a break into at least 1.1030 to 1.1027.

2-Hour EUR/USD Technical Analysis

The main trend is down on the 2-Hour chart.

The main range is 1.0855 to 1.1213. Its 50% level at 1.1034 is the closest downside target. This is followed by its Fibonacci level at 1.0992.

A new short-term range may be forming between 1.1124 and 1.1051. Its retracement zone at 1.1087 to 1.1096 provided resistance at 1.1093 a few hours ago.

A new intermediate range may be forming between 1.1188 and 1.1051. Its retracement zone at 1.1120 to 1.1136 is a potential target along with the swing top at 1.1124. A trade through this price will turn the main trend to up.

Based on the current price at 1.1058, look for a bearish tone to develop on a sustained move under 1.1051. Be careful shorting into 1.1034, however. The market could accelerate to the downside if this price is taken out with conviction.

If 1.1051 holds as support then buyers may make another run at 1.1087 to 1.1096. This is also a potential trigger point for a surge into 1.1120.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement