Advertisement

Advertisement

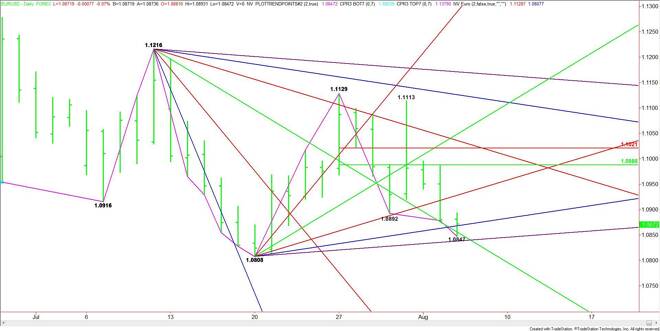

EUR/USD Mid-Session Technical Analysis for August 5, 2015

By:

Daily EUR/USD Technical Analysis The EUR/USD is rebounding after an early session setback, driven higher by weaker-than-expected ADP private sector jobs

Daily EUR/USD Technical Analysis

The EUR/USD is rebounding after an early session setback, driven higher by weaker-than-expected ADP private sector jobs data.

Buyers started to come in at 1.0847 as the market neared an uptrending support angle at 1.0838. The Forex pair also began to pick up a little steam when it crossed to the bullish side of a downtrending angle at 1.0856.

Crossing to the bullish side of the uptrending angle at 1.0868 and sustaining the move will mean that the short-covering is getting stronger. If new buyers come then look for a shift in upside momentum.

The daily chart indicates there is plenty of room to the upside if the EUR/USD can hold above 1.0868. The next potential target is another uptrending angle at 1.0928.

Currently, the market is in a position to post a potentially bullish closing price reversal bottom on the daily chart. If one does form then this rally could extend into 1.0988 to 1.1021 over the next few sessions.

The rally fueled by the ADP news was most likely short-covering and position-squaring. I don’t think real buyers came into the market because of general concerns about Friday’s U.S. Non-Farm Payrolls report. The reaction today is a strong indication of what to expect on August 7 if this report comes out lower than expected. Currently, traders are estimating the economy added 224K new jobs in July.

Into the close, the key angle to watch is 1.0868. Holding above this number will give the market a bullish tone with 1.0928 the next upside target. A failure to hold 1.0868 could pressure the market back to at least 1.0847 to 1.0838.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement