Advertisement

Advertisement

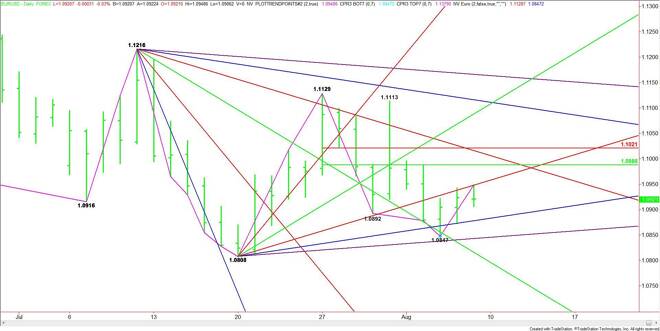

EUR/USD Mid-Session Technical Analysis for August 7, 2015

By:

Daily EUR/USD Technical Analysis The EUR/USD is trading lower at the mid-session. The Forex pair rallied early in the session, but sellers came in when

Daily EUR/USD Technical Analysis

The EUR/USD is trading lower at the mid-session. The Forex pair rallied early in the session, but sellers came in when the market tested an uptrending angle at 1.0948, triggering a break. The move did, however, help form a new main bottom at 1.0847. The selling pressure was likely related to position squaring ahead of today’s U.S. Non-Farm Payrolls report due out at 8:30 a.m. ET.

The main trend is down according to the daily swing chart.

Based on the current price at 1.0917, the direction of the market today will likely be determined by trader reaction to the angle which stopped the market earlier at 1.0948.

Taking out 1.0948 with conviction will likely trigger a rally into a 50% level at 1.0988. This is followed by a downtrending angle at 1.1016 and a Fibonacci level at 1.1021. The daily chart opens up over 1.1021 with the next potential target a downtrending angle at 1.1116.

A failure to overcome 1.0948 will signal the presence of sellers. We are seeing that at this time. The first target is an uptrending angle at 1.0878. This is followed by the closing price reversal bottom at 1.0847 and an uptrending angle at 1.0843.

If 1.0843 fails then look for the selling to extend into the main bottom at 1.0808. A trade through this level could trigger another steep sell-off with 1.0520 a potential target over the near-term.

Watch and read the price action at 1.0948 after the release of the jobs data at 8:30 a.m. ET. Trader reaction to this number will tell us whether the bulls or bears are in control. Expect increased volatility.

2-Hour EUR/USD Technical Analysis

The main trend is up on the 2-Hour chart. The trend turned up when 1.0943 was taken out last hour. The new main bottom is 1.0873. A trade through this level will turn the main trend to down.

The main range is 1.1113 to 1.0847. The first upside target is its 50% level at 1.0980. This is followed by the next main top at 1.0987. A trade through this top will reaffirm the uptrend. This is followed by the Fibonacci level at 1.1011.

The Fib level at 1.1011 is potential resistance, but also a trigger point for a strong surge with the top at 1.1113 the next likely upside target.

A trade through 1.0873 will change the main trend to down. This could create enough downside momentum to test the next main bottom at 1.0847. A trade through this level will negate the closing price reversal bottom and likely fuel a move into the next main bottom at 1.0818. The EUR/USD could accelerate to the downside if this number is taken out with conviction.

Based on the current price at 1.0917, the direction of the market into the close will likely be determined by trader reaction to the high earlier in the session at 1.0948.

Be prepared for volatility to return with the release of the jobs report at 8:30 a.m. ET.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement