Advertisement

Advertisement

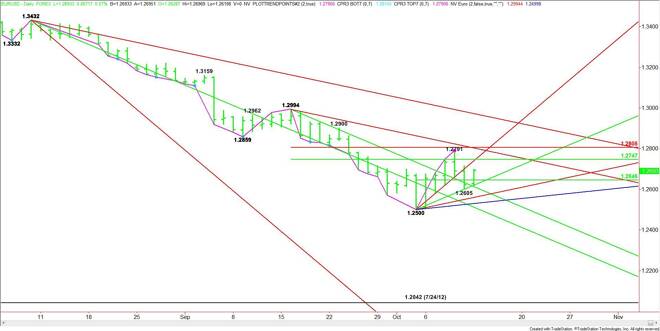

EUR/USD Mid-Session Technical Analysis for October 13, 2014

By:

Daily EUR/USD Technical Analysis The EUR/USD is trading flat at the mid-session. The market is currently trading above the short-term pivot price that is

Daily EUR/USD Technical Analysis

The EUR/USD is trading flat at the mid-session. The market is currently trading above the short-term pivot price that is controlling its short-term direction. The current price action suggests a secondary higher bottom may be being built. If it forms, it could lead to a breakout to the upside. If it fails to hold then look for another drive to the downside.

The short-term range is 1.2500 to 1.2791. Its mid-point at 1.2646 is the key pivot price that must hold to form the secondary higher bottom.

The support angle that held as support is at 1.2620 today. This is followed by additional angles at 1.2560 and 1.2530.

Holding the pivot at 1.2646 could trigger a rally into an uptrending angle at 1.2740 and another 50% level at 1.2747.

Overcoming 1.2747 could create enough upside momentum to reach a long-term downtrending angle at 1.2804, followed closely by the Fibonacci level at 1.2805. These two price actually form a potential resistance cluster.

The tone of the day will be determined by trader reaction to the pivot at 1.2646.

Hourly EUR/USD Technical Analysis

The main trend is up on the hourly chart. Taking out 1.2697 will reaffirm the uptrend, but there may not be an acceleration to the upside because of a retracement zone at 1.2698 to 1.2720.

On the downside, a trade through 1.2650 will turn the main trend back down. This should trigger a break back into the major retracement zone at 1.2646 to 1.2611.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement