Advertisement

Advertisement

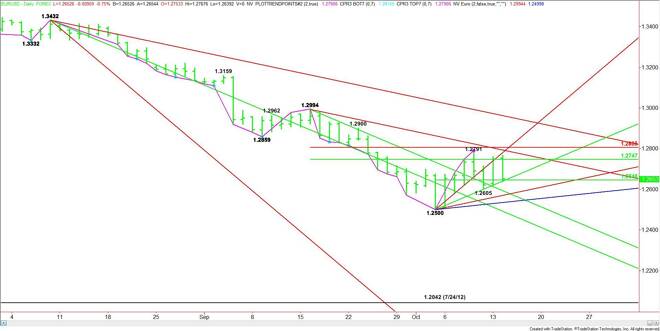

EUR/USD Mid-Session Technical Analysis for October 14, 2014

By:

Daily EUR/USD Technical Analysis The EUR/USD is ping-ponging between a pair of 50% levels today. The main range is 1.2500 to 1.2791. The 50% level of this

Daily EUR/USD Technical Analysis

The EUR/USD is ping-ponging between a pair of 50% levels today. The main range is 1.2500 to 1.2791. The 50% level of this range at 1.2747 is resistance.

The short-term range is 1.2500 to 1.2791. Its 50% level is 1.2646. This level is currently being tested.

The nearest uptrending support angle comes in at 1.2640. If this angle fails then look for the break to continue into the next pair of angles at 1.2570 and 1.2535. These are the last support angles before the October 3 bottom at 1.2500.

On the upside, the resistance is the retracement zone at 1.2747 to 1.2805. A downtrending angle at 1.2570 passes through this zone, making it a valid upside target also. A breakout over 1.2805 will also mean the market is on the bullish side of an uptrending angle at 1.2780. Both of these moves will indicate strong short-covering is taking place.

Hourly EUR/USD Technical Analysis

The main trend is down on the hourly chart. The main range is 1.2500 to 1.2791. The 50% level of this range is currently being tested at 1.2646. A failure to hold this level could trigger a sharp break into the Fibonacci level at 1.2611.

If the downside momentum is strong enough to take out 1.2611 then look for the selling pressure to continue with 1.2605 the next target. A failure at 1.2605 will likely trigger a further decline into the main bottom at 1.2500 over the near-term.

Holding 1.2646 will indicate that buyers are coming in to defend the downside. If the buying is strong enough to trigger a short-covering rally then look for the EUR/USD to rally back to the short-term retracement zone at 1.2698 to 1.2720.

Trader reaction to 1.2646 should set the tone into the close.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement