Advertisement

Advertisement

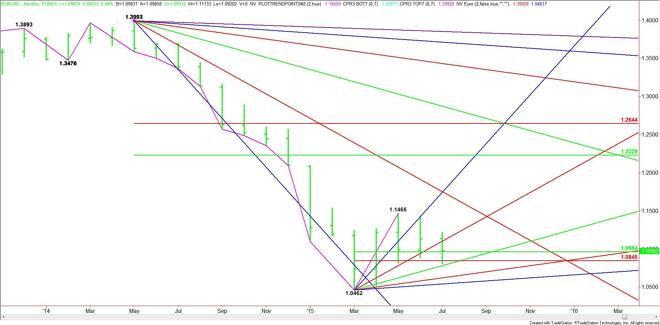

EUR/USD Monthly Technical Analysis for August 2015

By:

The EUR/USD finished July lower. Besides general concerns about Greece, the main catalyst behind the weakness was the divergence between U.S. Federal

The EUR/USD finished July lower. Besides general concerns about Greece, the main catalyst behind the weakness was the divergence between U.S. Federal Reserve and European Central Bank monetary policies. Simply stated, the Fed is on a path toward raising interest rates perhaps as early as September while the ECB is just four months into its quantitative easing program.

The direction of the market this month will likely be determined by trader reaction to the U.S. Non-Farm Payrolls report, due out on August 7. Traders estimate that 224,000 new jobs were added to the economy in July.

A number substantially above the estimate will be bearish for the EUR/USD because it will likely mean the Fed will begin raising rates in September. A number well below 224K will be bullish for the Euro. It will not necessarily change the trend to up, but it could cause a strong short-covering rally. A poor number will also likely mean the Fed will scrap a September rate hike and postpone it until December.

The main trend is down according to the daily swing chart. The short-term range is 1.0462 to 1.1466. Its retracement zone is 1.0964 to 1.0845. Trader reaction to this zone should set the tone for the month.

Look for a bullish tone to develop on a sustained move over 1.0964 and a bearish tone on a sustained move under 1.0845. Trading between these numbers will suggest trader indecision.

The market will strengthen if buyers can overcome a steep uptrending angle at 1.1262.

On the downside, look for an acceleration if the angle at 1.0862 fails as support. The next two targets are uptrending angles at 1.0662 and 1.0562. The latter is the last angle before the 1.0462 main bottom.

Watch and read the order flow and price action at 1.0964 this month. This will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement