Advertisement

Advertisement

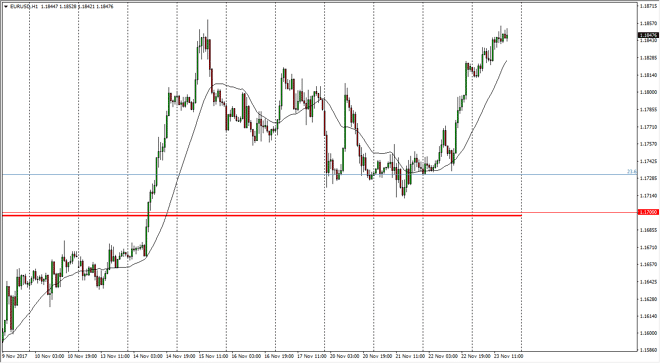

EUR/USD Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:07 GMT+00:00

The EUR/USD pair rose slightly during the trading session on Thursday, reaching towards the 1.1850 level. The market has been rallying as of late, and I

The EUR/USD pair rose slightly during the trading session on Thursday, reaching towards the 1.1850 level. The market has been rallying as of late, and I think at this point it’s likely that it continues to be a “buy on the dips” situation, and I think that the 1.17 level underneath continues to be the “floor” of the market. I like dips as they offer value, and I believe that the market breaking above the neckline of the previous head and shoulders pattern signifies that we are going to reach towards the highs at 1.21 next. Beyond that, the weekly chart is showing a bullish flag, which measures for a move all the way to 1.32 over the longer term.

The market should continue to favor the upside as U.S. Congress failures to write tax reform has put a lot of weight upon the US dollar. Right now, it looks as if we could find values on dips, and I think that longer-term traders are starting to hold on to the Euro in general. If we get some type of substantial tax reform, it’s likely that the market could pull back. However, I think that traders are starting to believe that the tax reform bill will probably be less than hoped for. In general, this is a market that continues to be volatile, but most certainly bullish. I expect a lot of noise, but with patience and proper position sizing, I think we could be looking at a longer-term trend change for good.

That being said, it is going to be very difficult over the next couple of months, as the ECB is looking to extend quantitative easing while the Federal Reserve is looking to tighten. While this should favor the downside move, traders are starting to worry about US politics more than anything else.

EURUSD analysis Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement