Advertisement

Advertisement

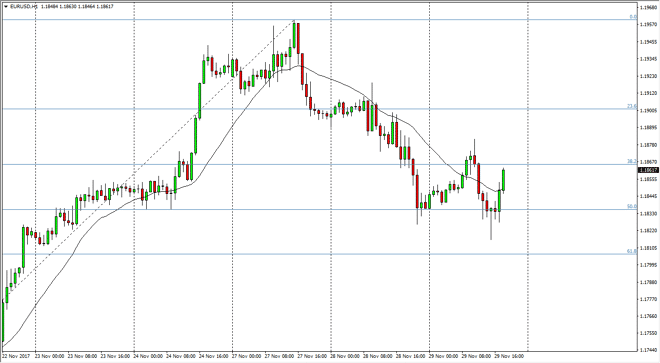

EUR/USD Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:07 GMT+00:00

The EUR/USD pair has been very choppy during Wednesday trading, bouncing from the 1.1825 region, but finding a significant amount of resistance at the

The EUR/USD pair has been very choppy during Wednesday trading, bouncing from the 1.1825 region, but finding a significant amount of resistance at the 1.1875 level. Longer-term, the market has been looking rather bullish as of late, so I am more inclined to buy some type of reversal pattern if and when we get it. Perhaps a “W pattern” on the hourly chart, or a “higher high” can be used to go long, but until then, I think that we are probably better off waiting for the appropriate signal. I certainly don’t have any interest in shorting a market that has rallied so much, so I think that it’s likely we will probably have to be very patient and wait for a better trading opportunity.

The US dollar of course is being very volatile due to a lot of unknown possibilities coming out of the U.S. Congress and its passing of tax reform. Because of that, it’s likely that the value the USD will fluctuate rapidly with headlines coming out of Washington DC. Currently, it looks as if the U.S. Congress is going to try to pass some type of tax reform, but until they do I think there is a certain amount of skepticism. We did see the tax bill passed the Senate committee, which is the first major hurdle to overcome, but there are a lot of other problems.

Having said all of that, as long as we are above the 1.17 handle, I have no interest in shorting this market as I think we are clearly still in an uptrend, and a complete reversal of what could have been a head and shoulders breakdown tells me that there is still a lot of underlying buying pressure. Regardless, position sizing will be crucial.

Euro to Dollar Forecast Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement