Advertisement

Advertisement

EUR/USD Price forecast for the week of December 4, 2017, Technical Analysis

Updated: Dec 2, 2017, 07:45 GMT+00:00

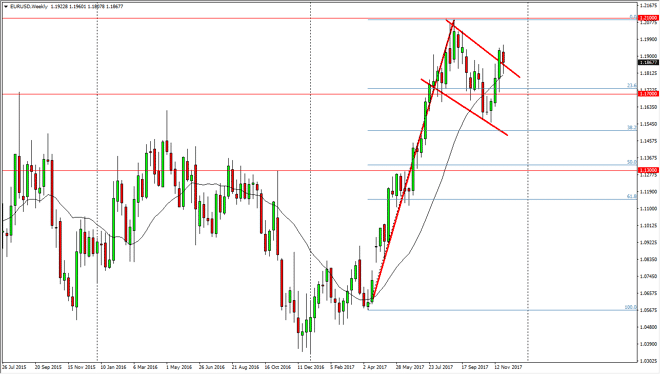

The EUR/USD pair has broken above a downtrend line in the last couple of weeks, and although it was a negative during the previous week, it looks as if buyers are starting to come back.

The EUR/USD pair initially tried to rally during the week but found enough resistance near the 1.1975 level to turn around and pull this market back down. However, by the end of the week we started to find buyers again, and therefore it looks as if we are eventually going to attract attention to the upside. When I look at the longer-term chart, I can make an argument for a bullish flag, which of course is a very strong sign. Because of this, I believe that you can measure the bullish flag for a move to the 1.32 level, but obviously is can take a very long time to make that type of impulsive move to the upside.

I believe currently that buyers are very much in control of this market, and that the 1.17 level underneath should be rather supportive. I also recognize that the 1.21 level above will be resistive, as it was the top of the flag, and the most recent high on the weekly chart. It makes quite a bit of sense, because there are a lot of concerns when it comes to the tax legislation coming out of the United States, which quite frankly seems to be less and less important. You can see that during most of the year we have been rallying, and breaking above the 1.15 level previously was a very bullish sign, as it was a breakout of multi-year consolidation. I remain bullish, but of course would add slowly, as it is a longer-term trade just waiting to happen. I think the 1.32 level makes a lot of sense from a structural standpoint look at the longer-term charts, but it’s going to take at least a year to get there.

EUR USD Forecast Video 04.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement