Advertisement

Advertisement

EUR/USD Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:13 GMT+00:00

The EUR/USD pair fell slightly during the week, continuing the bearish pressure that we had seen previously. However, the 1.17 level is an area that I am

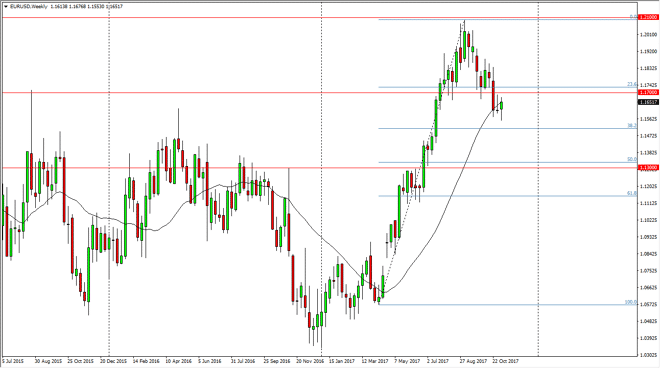

The EUR/USD pair fell slightly during the week, continuing the bearish pressure that we had seen previously. However, the 1.17 level is an area that I am paying a lot of attention to, as it was the neckline of a head and shoulders pattern, which is easier to see on the daily timeframe. As we initially fell, it looks like a simple continuation of the bearish pressure and of course an extension of the head and shoulders pattern, but we have turned around, mainly in reaction to the U.S. Congress being unable to get their act together with tax cuts. If that’s the case, we could see a complete reversal, but I cannot help but notice that the shooting star from the previous week sits just below the 1.17 handle, and if we can break above that and the 1.17 level, I think that’s a very strong sign for the EUR.

Because of this, I think you need to pay attention to this market, but more likely than not you will probably have to trade it from a shorter period chart for your entry. If we do breakout to the upside, we should go right back to the highs of the 1.21 handle. However, if we fail at the 1.17 region, we could roll right back over and then go looking towards the 50% Fibonacci retracement level, which is essentially at the 1.13 level, the area that the head and shoulders would measure to. This next week could be crucial for the future this pair, so be careful about your entry, and certainly pay attention. However, once things get a little bit more confirmed, it should lead to a nice trade over the next several weeks after such an impulsive move to the upside.

EUR USD Forecast Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement