Advertisement

Advertisement

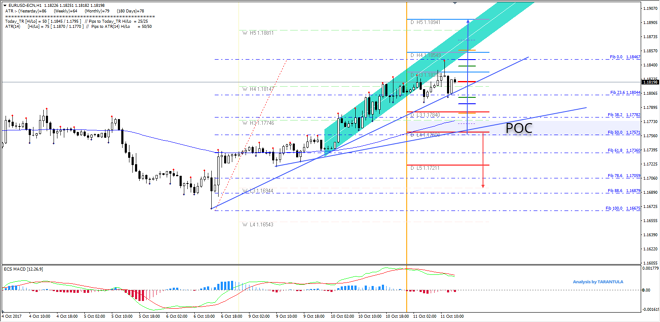

EUR/USD Trend Lines in Confluence with POC zone

By:

The EUR/USD is in a strong bullish trend and as we can see on the chart the price has pierced through 1.1800 driven by risk sentiment and the Spain

The EUR/USD is in a strong bullish trend and as we can see on the chart the price has pierced through 1.1800 driven by risk sentiment and the Spain situation. Today FOMC meeting minutes are the most important event so we might see two-way price action. At this point the price is still going up straight from the trend line and 23.6 fib. Continuation above 1.1855 aims for 1.1880 and 1.1895. However, if the price gets in a retracement phase watch for 1.1760-75 zone (D L4, EMA89, trend line, ATR low, W H3). Targets remain the same if the pair breaks 1.1810 on the bounce up. Only a move below 1.1750 might make a bearish breakout towards 1.1720 and 1.1695.

H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

PPR – Progressive Polynomial Channel

POC – Point Of Confluence (The zone where we expect price to react aka entry zone)

Follow @TarantulaFX on twitter for latest market updates

Sign up for Live Trading Webinars with Nenad Kerkez T

About the Author

Nenad Kerkezcontributor

M.Ec. Nenad Kerkez aka Tarantula is Elite CurrenSeas Head trader and a valued contributor to many premium Forex and trading websites.

Advertisement