Advertisement

Advertisement

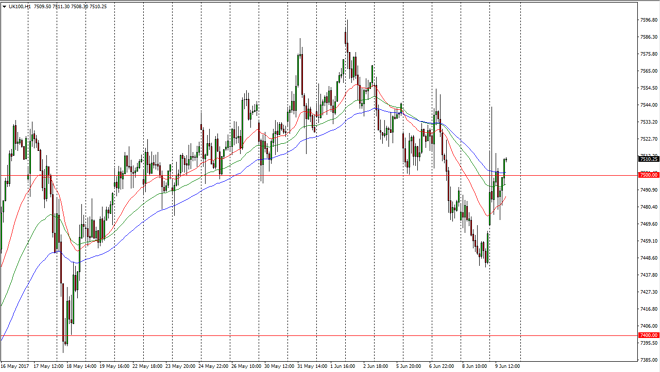

FTSE 100 Forecast June 12, 2017, Technical Analysis

Updated: Jun 10, 2017, 04:08 GMT+00:00

The FTSE 100 exploded to the upside during the session on Friday, as the British pound fell apart. This of course is good for the FTSE 100 which is

The FTSE 100 exploded to the upside during the session on Friday, as the British pound fell apart. This of course is good for the FTSE 100 which is heavily influenced by exports. The fact that we broke above the 7500 level tells me that the market is ready to go higher, although needless to say have been very volatile after the surprise election results. In the long-term, I believe the cooler heads have prevailed and we will continue to see buyers jump in. Given enough time, I believe that we will target the 7600 level and that short-term pullbacks continue to offer nice buying opportunities in a market that has been very bullish for quite some time.

Recent pullback offers value

I look at this market as one that’s offering value after a nice pullback, and that the buyers will continue to look at the FTSE 100 as a way to take advantage of British exports being cheaper than typical. After all, the GBP/USD and the EUR/GBP pair have been very bearish on the British pound recently, and that helps a lot with exports. While we do not know what the trade agreements are going to be after the United Kingdom leaves the European Union, the reality is that they are still a member of the EU, and therefore in the meantime different trading arrangements aren’t even a thought. Most traders are looking this morning at a market that has an extra boost from currency markets.

As for selling is concerned, I don’t have any interest in doing so until we get down below the 7400 level, because that has been such a massive support barrier in the past. If we did breakdown below there, the market could fall rather significantly. Any move below there could be rather rapid, and aggressive.

FTSE 100 Video 12.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement