Advertisement

Advertisement

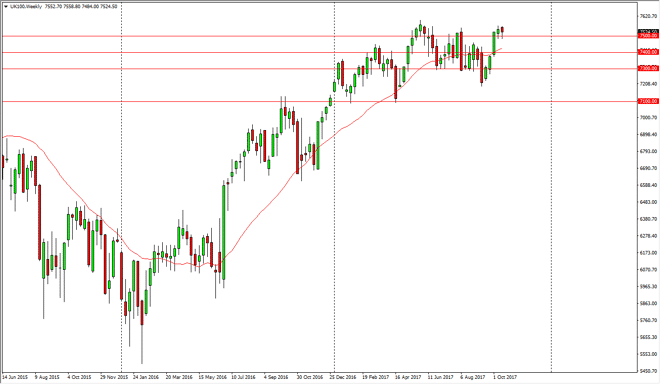

FTSE 100 forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:35 GMT+00:00

The FTSE 100 initially fell during the week, breaking below the 7500 level at one point, but bounced enough to form a bit of a hammer. The hammer of

The FTSE 100 initially fell during the week, breaking below the 7500 level at one point, but bounced enough to form a bit of a hammer. The hammer of course is a bullish sign, and I think that we will continue to see buyers jump into this market. Ultimately, this is a market that continues to see plenty of support underneath, and the 7500-level offering support is a sign of the overall bullish attitude underneath. I think the given enough time, we should go rallying towards the 7700 level, based upon the recent consolidation being broken. I think that the historically cheap British pound continues to help as well, but I also recognize that perhaps the negativity surrounding the United Kingdom has been overdone and we should continue to see interest in the United Kingdom both in the currency markets, and the stock markets.

If we can clear the 7600 level, I think more money will flow into the market, pressuring the market to the upside. Given enough time, it’s likely that we will continue to see extreme amounts of volatility, but ultimately, I think that the recent push higher has been a sign of just how much conviction there is by the bullish traders in this market, and that is reason enough for me to start buying. The markets continue to look as if pullbacks offer value, and that value is something that I am more than willing to take advantage of. By going long, I am going to add slowly on the way higher, and build a large position that I can hang onto for several weeks, if not several months. It is not until we break down below the 7200 level that I would be concerned with the overt uptrend.

FTSE 100 Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement