Advertisement

Advertisement

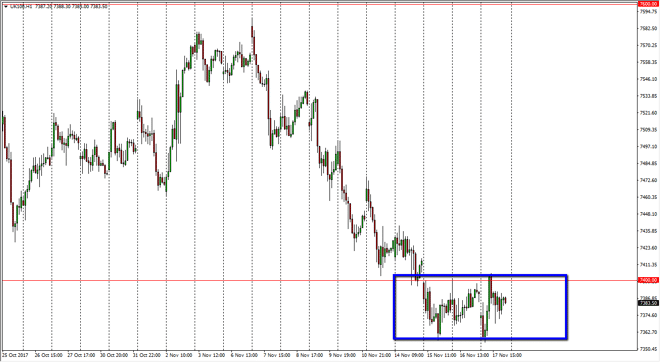

FTSE 100 Index Forecast November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:33 GMT+00:00

The FTSE 100 has been extraordinarily volatile during the Friday trading session, testing the 7400 level. That area has been supported in the past, and

The FTSE 100 has been extraordinarily volatile during the Friday trading session, testing the 7400 level. That area has been supported in the past, and now looks to offer resistance. If we can break above the 7435 handle, I think that the market can pick up momentum and continue to go higher, perhaps reaching towards the 7600 level over the longer term. Alternately, if we break down below the 7350 handle, the market then probably drops to the 7200-level underneath, which is the bottom of the larger consolidation area. With the cheaper British pound, exports in the United Kingdom should pick up. That tends to help the FTSE 100 overall, but beyond that we need to look at the fundamental outlook for stocks in the United Kingdom as well.

Looking at this chart, I cannot help but think we are trying to form some type of basing pattern, and the clearance of the 7435 level is a confirmation of that. A breakdown below the 7360 handle would send this market much lower as I said, but I believe that it is only a temporary move. I would be a short-term cellar, but looking towards the longer-term charts to pick up value underneath. I do believe that longer-term we not only rally but break above the 7600 level, but right now we continue to see volatility and therefore we have to play this market from a short-term perspective. By using dips to pick up value, you can find several trades between now and the impending break out. As we had sold off so drastically over the last couple of weeks, I believe that we are starting to see people tried to jump in and pick up value and take advantage of the longer-term move.

FTSE 100 Video 20.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement