Advertisement

Advertisement

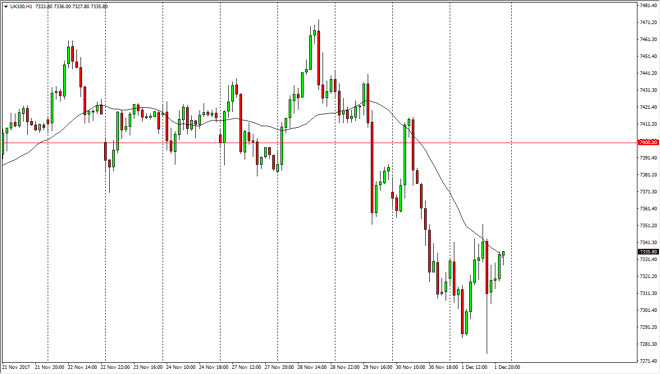

FTSE 100 Index Price Forecast December 4, 2017, Technical Analysis

Updated: Dec 2, 2017, 07:40 GMT+00:00

The FTSE 100 has been very volatile during the trading session on Friday, but currently it looks as if we are ready to go anywhere. Perhaps we are trying to rally a bit, but I also recognize that the 7400 level above is resistive.

The FTSE 100 went sideways during the trading session on Friday, as we continue to see a lot of volatility. I think personally that we are going to rally from here and go looking towards the 7400 level above. That is “fair value” of the overall consolidated area that the market has been trading in between the 7200 level and the 7600 level. Ultimately though, I think that the 7400 level will offer a lot of resistance and of course support if we can break above it. Right now, I think the volatility continues, but I suspect that given the fact that we have broken down below to fresh new lows on the short-term charts suggest that we are going to go down to the 7200-level underneath. That is an area where we should see a lot of support though, so I don’t think that we are going to break down below there, so I think it’s more or less going to be a shorter-term opportunity for sellers. Longer-term, I still believe that the 7200 level offers a longer-term buying opportunity, and I think that the buyers would get involved. I think the stock markets in general have been a bit overbought, so this pullback makes quite a bit of sense. This offers value, so we have to clear levels to trade from, and because of this is likely that we would have relatively clear signals soon. Pay attention to the 7400 level, the signs of exhaustion there could be and I selling opportunity just as a breakdown below the lows would be, but again, at the 7200 level I think the buyers will take over again.

FTSE 100 Video 04.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement