Advertisement

Advertisement

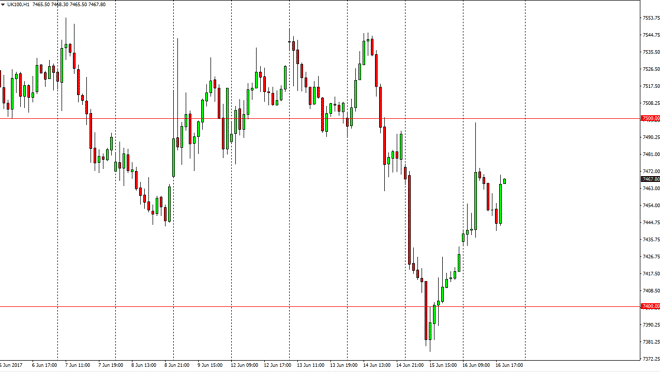

FTSE 100 Index Price Forecast June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:11 GMT+00:00

The FTSE 100 gapped higher at the open on Friday, and then shot towards the 7500 level. That’s a very bullish sign, as we then pulled back but it now

The FTSE 100 gapped higher at the open on Friday, and then shot towards the 7500 level. That’s a very bullish sign, as we then pulled back but it now looks as if the market should continue to go higher, as the FTSE 100 has been very bullish over the longer term. We have recently seen a significant pullback, but quite frankly I think a lot of that comes down to the headlines coming out of the political spectrum in the United Kingdom. I think this is a short-term phenomenon, but is starting to fade away, so it’s likely that the buyers have returned for a longer-term move. If we can break above the 7500 level, the market should then go looking for the 7600 level.

Looking to buy dips

I am looking to buy dips in the FTSE 100, as we have seen more than once. The markets continue to look very volatile, but that’s part of what will make this a nice trading opportunity from what I can see. I think that the markets will continue to be bullish in general, but the markets are probably best traded with small positions as we may get sudden turnarounds without warning. After all, I won’t take much for somebody in London to say something that’s going to scare the market, as politicians continue to talk about the divorce from the European Union. Because of this, a smaller position allows you to stay in the market for a longer time. Once we break above the 7500 level, I would be willing to add to my position. Ultimately, the market should continue to see people jump in overall, and perhaps go as high as 8000 over the longer term.

FTSE 100 Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement