Advertisement

Advertisement

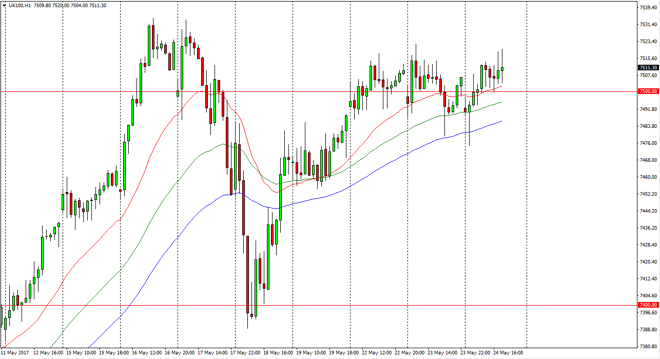

FTSE 100 Index Price Forecast May 25, 2017, Technical Analysis

Updated: May 25, 2017, 03:49 GMT+00:00

The FTSE 100 initially gapped lower at the open on Wednesday, but found enough support near the 7475 level to bounce and continue to go higher. We are

The FTSE 100 initially gapped lower at the open on Wednesday, but found enough support near the 7475 level to bounce and continue to go higher. We are currently churning around the 7500 level in general, so I think we are trying to build up enough momentum to finally break out to the upside and continue the longer-term uptrend. We have seen a lot of volatility as of late, and this should continue to be the case as there are going to be a lot of headlines and comments coming out of Great Britain and the European Union regarding the United Kingdom leaving the EU. This is going to make the FTSE 100 a very interesting place to be over the next year or so, and I think volatility will continue to be a real threat.

Long-term bias to the upside

I still believe that the long-term bias must be to the upside, and that when markets pull back, they are simply “on sale.” After all, the British economy is one of the largest in the world, so even if it does leave the European Union, it isn’t like the United Kingdom is going to suddenly fall apart. There are plenty of agreements to be made as far as free-trade is concerned, not the least of which would be with the United States, which has a market roughly the same size as the EU. With this, I believe that eventually the British will overcome any doubt, but in the meantime, look at pullbacks as value. A break above the 7540 level sends us to much higher levels in the meantime, so I believe that you should still be thinking of this is a “long only index.” Because of this, selling isn’t even a thought.

FTSE 100 Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement