Advertisement

Advertisement

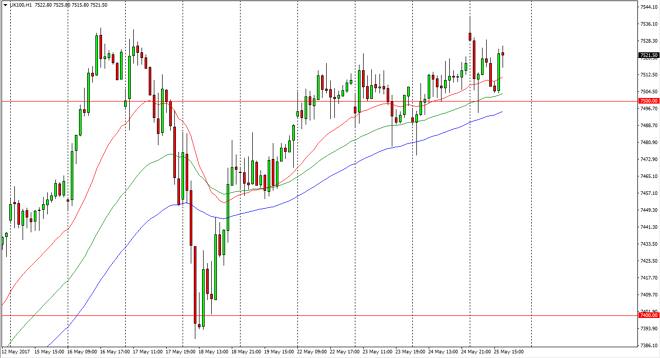

FTSE 100 Index Price Forecast May 26, 2017, Technical Analysis

Updated: May 26, 2017, 04:06 GMT+00:00

The FTSE 100 initially gapped higher at the open on Thursday, and then reached much higher from there. We turned around to form a shooting star on the

The FTSE 100 initially gapped higher at the open on Thursday, and then reached much higher from there. We turned around to form a shooting star on the hourly chart, and then fell significantly. The 7500-level underneath continues to be important, just as the moving averages are that I follow as well. I believe that the market is going to continue to grind higher, so therefore buying dips will probably be the best way to trade this market as we are trying to break out above a significant resistance barrier. Once we cleared the 7535 handle, I think that the market will then reach towards the 7550 handle, and then 7600. This is a market that continues to show quite a bit of bullish pressure, and it now looks as if we are trying to build up enough volume to break out.

The grind higher

The best way to describe this market as it is going to grind higher. The market won’t be an easy one hang onto, but if you can be very patient about what’s going on, you should be able to unlock some value in profit on this trade. The market should be supported by the 72-hour exponential moving average on the chart, colored in blue, and it’s not until we break down below there that I would be worried about the momentum of the grind. Currently, this is a market that will favor dips as value and that being the case one of the best ways to play this market would be to buy little bits and pieces as we go higher. I have no interest in selling into we break down below all the moving averages and the 7500 level. Even then, I would have to take a serious look at the next move.

FTSE 100 Video 26.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement